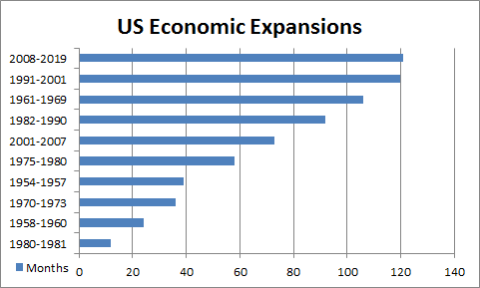

Today officially marks the longest recovery in US economic history. At 121 months the 2008-2019 expansion officially overtakes the 1991-2001 expansion. Here’s an overview of the post-war economic expansions:

The most interesting bit here is that the expansions seem to be getting longer. I’ve written about this in the past and the reasons why the expansions seem to be expanding. The key points are:

- Monetary policy combined with fiscal policy’s automatic stabilizers are more likely to support any downturn than they were in the past.

- The global economy and the US economy in general has become much more diversified which makes it a more stable overall growth pattern.

On the flip side, while this is a long recovery, it’s also a relatively weak one with real GDP coming in at just 2.2% per year vs the average of 4.4% for all other recoveries. But while it’s been a weak recovery it’s important to remember where we’ve come from (the worst global downturn since the Great Depression) while also remembering that long and slow isn’t necessarily a bad thing. In fact, I’ve called this the era of irrational apathy because there is so much good stuff going on that seems to get ignored due to expanding inequality.

But back to our original question – does it matter how long the recovery is? Hmmm. This seems like the wrong question. After all, economic cycles are a bit like sex – they happen slowly and then suddenly. But it’s not the quantity that matters so much as the quality relative to the quantity. A 10 minute expansion with a good ending can be a lot better than a 60 minute expansion with some people feeling less than satisfied, if you know what I mean.

And that’s where it’s important to put the length of the recovery (get your mind out of the gutter) in perspective versus the quality of the recovery. Think of it like a portfolio manager – would you rather earn 10% returns in a manner that booms and busts or would you prefer to just earn a 7.5% with a nice smooth return? Some people might want the higher returns, but the higher returns come with higher risk of behavioral mistakes and cash flow unpredictability. Similarly, economic cycles that involve big booms and busts will test more people in more ways than might be desirable.

And that’s what brings us to the current expansion – while it’s been a weak expansion there are no obvious signs of a widespread boom. And the booms are what we need to be most concerned about. Yes, there have been pockets of unsustainable growth (such as San Francisco house prices and perhaps the stock market boom), but there hasn’t been a widespread surge in any specific part of the economy that is likely to cause a large and sustained bust. And that’s why I believe that if there is a bust it will be a fairly mild bust. So, yes, the expansion has been long, but it’s been smooth and that could be a good thing because it means that it won’t end with a big bust. Or, to use a previous analogy, our expansion likely won’t end with a big bang, and in the case of the economy, that is a good thing.

NB – I considered adding all sorts of the usual footnotes here, but honestly they were getting a little out of control so you’ll have to settle for the article as it is.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.