Every time the inflation report comes out you get analysts and investors complaining about how the government excludes food and energy in the core prices. There’s a very reasonable explanation for why they do so – the volatility created by these inputs generates a skew in the data that could lead to inaccurate conclusions regarding the true state of inflation. Of course, even policymakers make mistakes using this data (often because they are being reactive to data rather than proactive), but the thinking behind this “ex food and energy” makes a great deal of sense.

Now, small investors are particularly irritated by this because all they see on a daily basis are food and gas prices. We tend to be overly obsessed by that which is constantly in our face. It’s one of the many biases that influence our daily lives and lead us to irrational conclusions. Food and energy are just two of the hundreds of inputs in the consumer inflation data. I constantly harp on the fact that housing gets a bum rap despite being the most important monthly consumer cost – by a wide margin.

But there’s a more important point here. While consumers and small investors are busying complaining about headline inflation, savvy investors are busy worrying about the core. This ties neatly into recent discussions on the bond market and why rates are so tightly correlated to Fed policy. After all, the Fed has been abundantly clear that they are concerned with core inflation and not headline. So it’s not surprising to see a very high correlation between bond yields and Fed policy.

But what’s even more interesting in this whole discussion is a look at the correlations between bond yields and inflation. If you back the inflation data out over 20 years and review the correlations between headline CPI and core CPI you’ll actually find that the bond market cares very little about headline CPI.

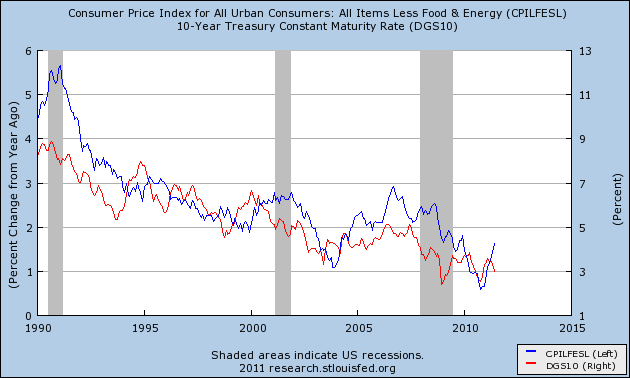

(10 year yields vs core CPI)

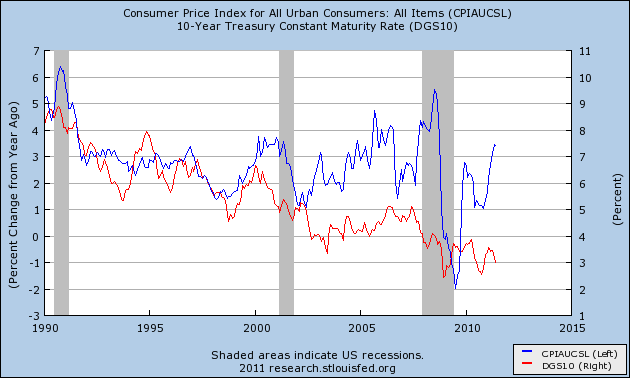

(10 year yields vs headline CPI)

If you run a little data analysis on these two data sets you’ll find a 83% correlation between core CPI and 10 year yields and just a 52% correlation between headline inflation and CPI. The bottom line: the bond market doesn’t give a damn about headline CPI.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.