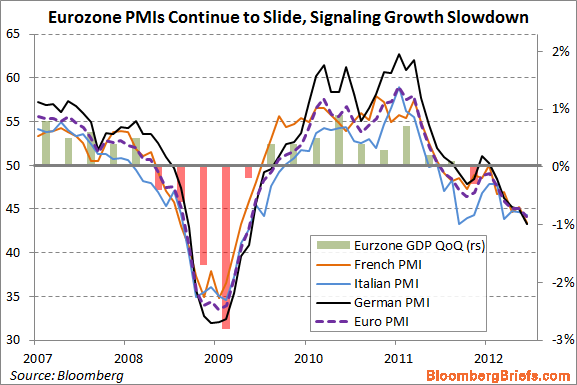

Today was the big global PMI data dump and one thing continues to stand out here – Europe is a total disaster. Here’s the round-up from today’s readings:

- Eurozone: 44.0, down from 45.1

- Spain: 42.3, up from 41.1

- Germany: 43.0, down from 45.0

- Italy: 44.3, down from 44.6

- Greece: 41.9, up from 40.1

- France: 43.4, down from 45.2

- Ireland: 53.9, up from 53.1

Chris Williamson of Markit offers his condolences to what is clearly a wrecking ball of a monetary system, but does offer one bright spot in this mess:

“The only country to show any sign of emerging from the downturn so far this year is Ireland, where output is beginning to increase again due to rising exports. The brighter picture from Ireland perhaps sends a message that other countries do not necessarily face the inevitability of deepening downturns if competitiveness can be improved, though the current weakness of global economic growth suggests that all producers face a challenging environment in export markets as well as at home.”

(Chart via Bloomberg)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.