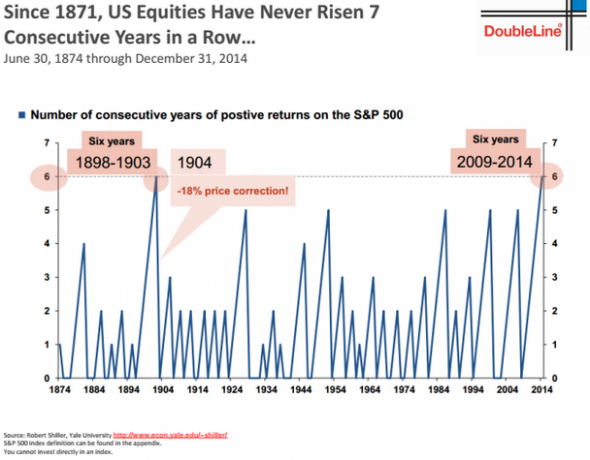

FT Alphaville discusses a chart from Jeff Gundlach’s presentation the other day which showed that stocks have never risen 7 years in a row:

The obvious conclusion is that this is extremely bearish for US stocks because this would be the seventh year of rising stocks and that just doesn’t happen, ever. But how useful is this really? Not very.

This is a form of the Monte Carlo fallacy or the Gambler’s Fallacy. In my book I described this as follows:

“We tend to think that a random event is more or less likely to occur following a series of similar events. I had a college friend who swore that he had figured out how to win at roulette. Falling for the Gambler’s Fallacy, he claimed that we just needed to wait for a series of same spins to occur and then we would bet against that outcome because the odds would then favor us. What he was missing was that each spin in roulette is a unique environment with exactly the same odds and no connection to the last one spin or the last one million spins. We didn’t use his strategy, thankfully. Markets and money aren’t perfectly analogous, but each business cycle and market cycle is going to have a unique flavor. The past may rhyme, but it doesn’t necessarily repeat. John Templeton once said that the four most dangerous words in markets are “it’s different this time”. I disagree; each cycle is always different because each cycle has a unique environment, catalysts, participants and variables driving it.”

Relying purely on the past to guide your future decisions is usually a disastrous decision in the markets. This doesn’t mean there’s no connection between past market events and future market events. But I think it’s very useful to view the markets as unique environments and to try to gauge a particular environment’s drivers as opposed to simply extrapolating the past into the future and assuming that the future will look like the past.

* An earlier version of this post said the 2011 return of the S&P 500 was negative. The price return was negative, total return was positive. Stupid me.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.