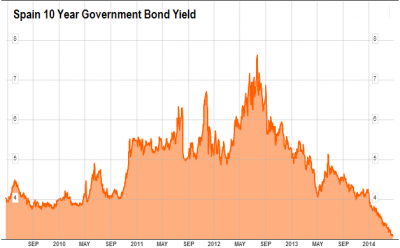

While I was busy beating my chest yesterday over low yields in the USA and my many dismissals of a “bond bubble” in the USA, I conveniently left out an even bigger bull market in bonds (that I totally missed since 2012). Last night, Spain sold 10 year bonds at 3.06%. That’s the lowest yield since 2005 and fast approaching a record low.

This is incredible in my opinion. I mean, it’s not incredible that a credible central bank can control interest rates if it really wants to, but the fact that we’re at record lows is simply stunning. Even more amazing, the average yield to maturity on Greek, Irish, Italian, Portuguese and Spanish debt has fallen to 2.19%, the lowest since 1998.

What’s interesting here is that Spanish 10 years have not only averaged twice this level since 1991, but that Spain’s debt to GDP continues to worsen (it was 93.9% in Q4). To be honest, I don’t know exactly what’s going on here and there are probably too many moving political pieces to really know. Obviously, the central bank backstop is the driving force, but the market seems to be pricing in something even more extreme than that. In essence, it looks like European debt of all types is once again becoming indistinguishable to a large degree. This sort of convergence implies that there is a greater chance of a supranational entity in Europe’s future which makes the incomplete monetary union reflect something more like the USA where there is a unified Treasury, Central Bank and currency system. I’ve written in some detail about the strong likelihood that Europe is moving towards a United States of Europe of some type.

I don’t know where this is all headed, but it sure looks like the easy money has been made in peripheral bonds. A more unified Europe would be great in my opinion, but we have to wonder if the market isn’t unrealistically optimistic about what lies in our immediate future with regards to how unified these nations are actually willing to become. A central bank can piece this together for a long time, but at some point after multiple depressions and rebalancings via wage channels (including depressions as we’ve seen in the periphery) there needs to be real political change and that’s where the rubber meets the road on how much a Spanish bond really resembles a German bond.

Related:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.