I am going to do something very unpopular in this post – I am going to declare that the economy is healthier than it commonly gets credit for. I’ve noticed that it’s common in the mainstream media to speak about the US economy as if we’re in some sort of permanent malaise where we’re not really improving. In fact, from the way some media outlets talk about the economy you’d think that we’re in a recession. But the data actually says that this hated recovery is doing better than it often gets credit for. Here are some higlights:

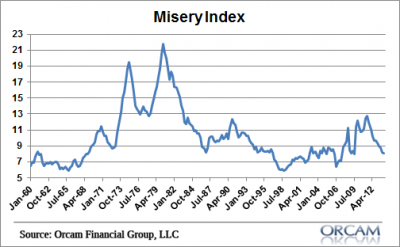

The Misery Index, the sum of the unemployment rate and the rate of inflation, is at 8.1%. That’s low by historical standards with an average of 9.5% since 1948.

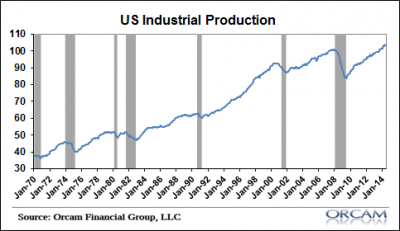

Yesterday’s report on industrial production showed an all-time high in US manufacturing. Yes, it’s struggled back, but at 3.2% year over year growth we’re almost 1% above the 40 year average of 2.4%.

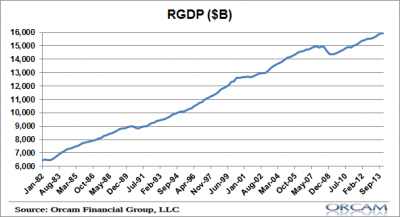

Real GDP hit an all-time high in Q1 of 2014 and if Q2 estimates hold up we should see the strongest quarter of growth since the recovery began.

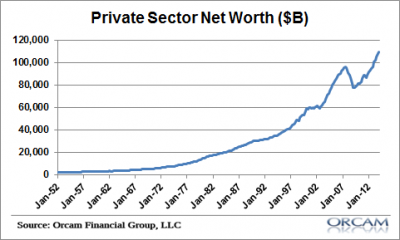

Perhaps most importantly, private sector balance sheets have improved tremendously. The net worth of the private sector reached an all-time high in Q1 2014.

I know this is an unpopular narrative. And I know the recovery has been sluggish and uneven. But there’s been a lot to like about this recovery as well. And I think we’re so busy focusing on the recent financial crisis that we’ve completely missed a lot of the good stuff that’s gone on over the last 5 years.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.