Meredith Whitney made waves in December when she predicted that 2011 would be the year of hundreds of municipal bond defaults. The backlash from her comments reverberated throughout the investment world. Several notable investors came out to say the claims were overdone and many others jumped on the bandwagon to spread fears of a European style budget crisis. In January I said Mrs. Whitney was wrong and that the muni bond crisis was overblown. Not 3 months later, the crisis thesis is already looking like it’s off the table.

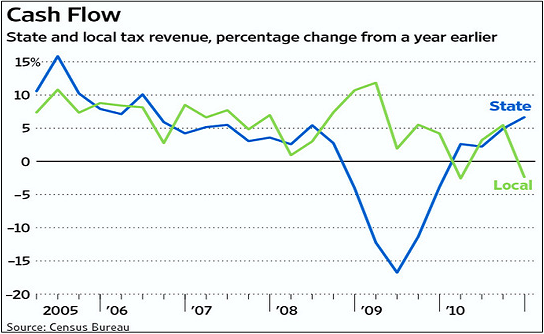

The latest data from the Census Bureau on state and local governments shows a snap back in revenues. Total revenues are now just 2.3% shy of the all-time high. This is excellent news, however, the recovery is somewhat uneven. The WSJ highlights the discrepancy in state and local revenues:

“The latest tallies show a diverging trend in the fiscal health of state and local governments. While state tax revenue increased every quarter of 2010, including a 6.7% jump in the fourth period compared with a year earlier, local tax revenue fell in the first and fourth quarters—in part because of slumping real-estate tax receipts.

While states are primarily funded by sales and income taxes—which tend to grow along with an expanding economy—the nation’s 89,000 cities, school districts and other local governments depend heavily on property taxes.

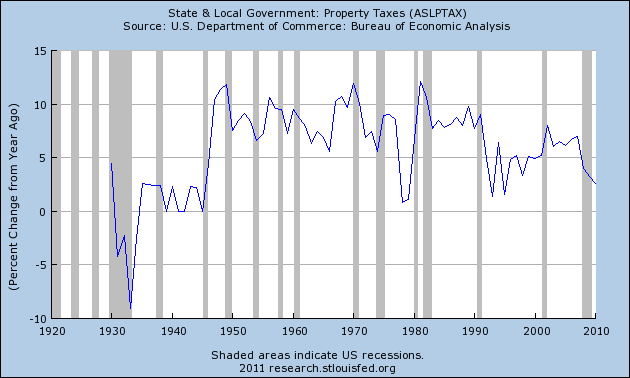

It typically takes a few years for falling housing prices to show up in property-tax receipts, and the latest Census figures suggest that is now happening.”

This should continue to be a headwind for local government’s as the lag in property taxes continues to put pressure on budgets. As recent housing data shows, we’re seeing continued declines in housing prices (I’ll be updating my housing outlook shortly). But on the whole we are beginning to see a slowing in the rate of property tax receipt decline:

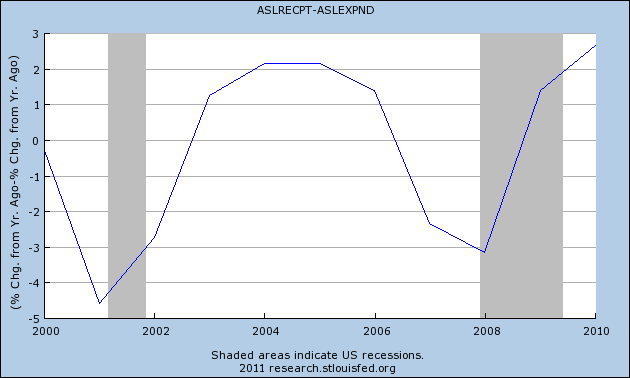

More importantly, however, the overall picture is now stabilizing. Total receipts are now outstripping expenditures at 2.6% year over year growth. This by no means says the budget woes are over, however, there are definite signs of improvement. Austerity is likely to continue to kick-in at the state and local level and tax receipts should continue to move sluggishly higher under my weak recovery scenario. It’s not exactly a recipe for booming growth, but it’s also not setting the table for a European style crisis and economic doom and gloom that many have predicted.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.