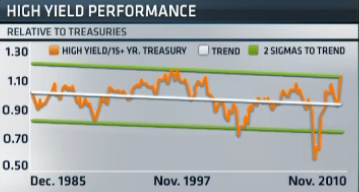

Jeffrey Gundlach, DoubleLine Capital CEO was on CNBC’s Strategy Session today to discuss the bond markets. Gundlach believes the risk adjusted returns from high yield bonds should be poor going forward as investors price in perfection of low defaults going forward. Gundlach also noted the historical performance and unusual spreads in high yield:

Gundlach isn’t saying the high yield market will collapse, but he believes risk adjusted returns will be poor compared to GNMA’s due to the likelihood of higher defaults in the coming years. Gundlach says there are signs of irrational exuberance in high yield and that 2013 could mark the beginning of the next default cycle.

In part 2 Gundlach discusses why he believes the muni market is a ticking time bomb. He says the fundamentals are undeniably bad. In many ways munis are comparable to sub-prime. He says munis are likely to decline 15-20% from current levels and result in a panic phase in the muni cycle.

Part 1:

Part 2:

Source: CNBC

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.