Remember all that chatter earlier this year about the “great rotation” and how bonds were going to get crushed because everyone was “rotating” into stocks? That seems to have died down quite a bit in recent months, but just to put a nail in that coffin I wanted to point to the actual data.

But first, let’s remember a basic macro lesson – all securities issued are always held by someone. If you sell your stocks to “rotate” into bonds then someone else is selling their bonds to “rotate” into stocks. In the aggregate, people don’t “rotate” out of existing financial assets and into other financial assets. They simply exchange financial assets and the value of those assets may or may not change in the process. That’s simple enough, right?

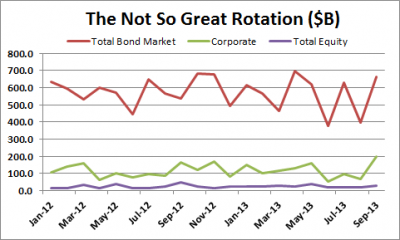

But that’s only the secondary market. What about the primary market where actual issuance is occurring? Well, the “great rotation” myth looks even more ridiculous if you look at the data there because the issuance of debt in the USA has massively dwarfed the issuance of equity in recent years. And it not’s just government related debt. Corporate debt has outpaced equity issuance by a huge margin (roughly 10:1 per month over the last 2 years).

Here’s the chart showing monthly issuance of corporate debt, corporate equity and total bond market issuance. As you can see, this one pretty much puts the nail in the “great rotation” coffin.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.