The latest NY Fed quarterly on US household debt trends won’t come as much of a surprise to regular readers here. I don’t even want to think about how many posts I wrote about the household debt crisis and the balance sheet recession over the last 5 years. Luckily, it looks like we’re closing the book on that chapter (for now at least). The NY Fed officially declared the end of the deleveraging at the US household level:

“Outstanding household debt, led by increases in auto loans, student loans and credit card balances, has steadily trended upward in recent quarters,” said Wilbert van der Klaauw, senior vice president and economist at the New York Fed. “In light of these data, it appears that the deleveraging period has come to an end and households are borrowing more.”

Well, they were about a year later than I was to make this declaration, but better late than never, right?

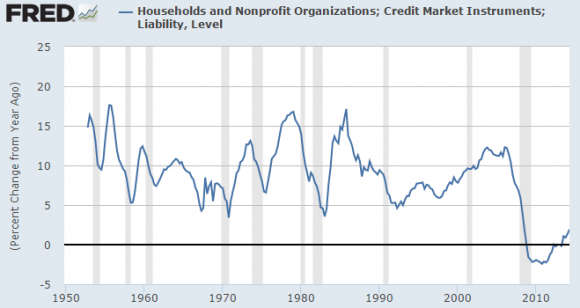

More importantly, I think it’s important to note that while the deleveraging is over the releveraging is still very weak. As you can see below US households are releveraging, but they’re releveraging at a pace that is very low by historical standards. So yes, we’re making progress, but we shouldn’t all get too excited just yet. In my view, the weak borrowing is still a sign that household balance sheets are too weak to be burdened by substantially more debt. And that’s a big problem for aggregate demand and the US economy which is operating well below capacity despite some decent economic news in recent years.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.