By now you’ve probably read plenty of stories about how the Ryan budget plan would turn us into Greece via austerity or result in massive cuts in various important programs. And now Goldman Sachs analysts are out with a pretty comprehensive analysis comparing the Ryan and Obama budget proposals. The difference is noticeable, but actually very similar in terms of their overall effects (via Zero Hedge):

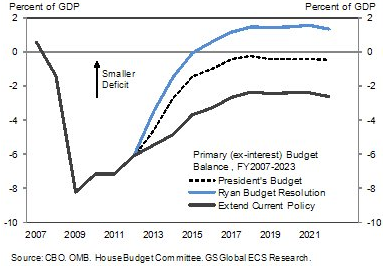

“Both proposals would reduce the deficit significantly relative to current policy. The President’s would bring the budget nearly to primary balance (i.e., spending excluding interest expense would be nearly equal to revenues). Rep. Ryan’s budget resolution goes well beyond this, proposing to bring the deficit to primary (ex-interest) balance by mid-decade. Assuming that the Treasury’s average borrowing rate is roughly equal to nominal GDP growth, bringing the budget into primary balance should be enough to stabilize the debt-to-GDP ratio, with the primary surplus the Ryan plan proposes in the second half of the decade enough to reduce it.”

Exhibit 1: President’s budget would nearly eliminate primary deficit, while Ryan proposes a primary surplus

The scare mongering about becoming the next Greece is certainly steering the ship here. As Warren Mosler likes to say, “because we’re afraid of becoming Greece, we’re turning ourselves into the next Japan”. Let’s hope the “extend current policy” scenario plays out so that we can continue to heal the remaining devastation caused by the balance sheet recession. But the worst part of all this is the sense of hopelessness knowing that neither candidate seems to understand the disease that is killing the US economy.

Source: Goldman Sachs

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.