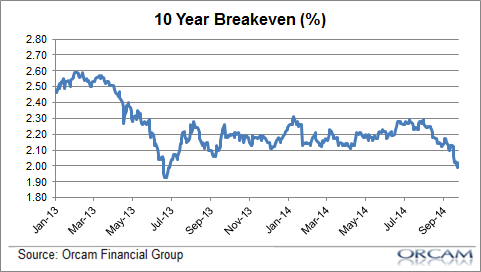

Very good insight here from Sober Look – inflation expectations are falling fast again:

“The 5-year real rates in the US have recently turned positive, which some would suggest represents tighter monetary conditions. With real rates on the rise, the Fed will have a great deal of room to “slowroll” the rate hikes. If inflation expectations fall further, we may see a more dovish stance from the FOMC. “

Yes, that means one thing – if you’re betting on tighter Fed policy any time soon then this doesn’t bolster your case. We’re seeing low inflation around the globe, continued economic weakness and with inflation expectations falling even further it means that global central banks have more breathing room to continue with their accommodative policy.

I continue to see lots of commentators talking about how “tapering is tightening” or how the Fed is likely to tighten in early 2015. This indicator makes that a very unlikely scenario unless things change quickly and dramatically….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

jswede

If the Fed is shortsighted enough to hike rates in 2015, like most pundits believe, they’ll be cutting again within a year – possibly sooner. Much like the ECB in 2011: they had tepid <1% GDP growth, and tried to 'bluff' the market to induce confidence by hiking from 1.00% to 1.50%… this was followed by 5 straight negative GDP readings and now 145bps of rate cuts to the current 0.05% rate.

Personally I don't think the Fed hikes at all.

Geoff

Do you think it makes a difference that the falling inflation expectations are due to a rising real yield as opposed to a falling nominal yield?

John Daschbach

Brad DeLong has a better figure which includes the 5yr break-even rate as well.

“The people putting their money on the line in financial markets now think that the Federal Reserve is going to undershoot its 2%/year inflation target by a cumulative total of more than 2%-points over the next five years.

And the Federal Reserve’s Open Market Committee is thinking of tightening monetary policy?”

https://equitablegrowth.org/2014/09/24/five-year-inflation-breakeven-now-1-6year/

Yancey Ward

I will stick to my prediction- the 10Y will be under 1% at some point in the next 5 years, and the Fed will institute negative rates on the short end. I think it inevitable.

blonderealist

I’ve been waiting for all those people freaking out about QE and “the Fed funding the deficit” to explain why rates have not shot up since tapering began in earnest.

The muddle through continues, it will continue longer than we thought it would a few years ago, and the Fed will keep rates low longer than most predicted at the beginning of 2014 because there’s just no overheating in the economy happening to any broad extent.

Benny Lavva

The US TIPS coupons adjust for the headline CPI, which includes energy prices. As Cullen had previously (correctly) noted, the bond market generally cares about the core CPI. The breakevens are therefore most likely low due to soft oil prices we’ve been seeing recently, and they are unlikely to prevent the Fed from hiking the policy rate next year, as planned.