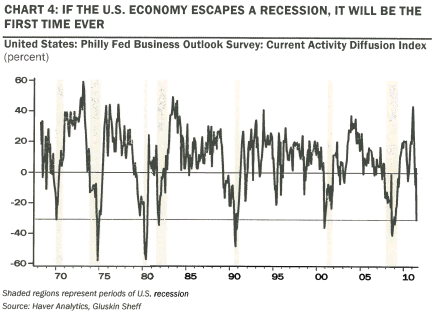

Just how bad was yesterday’s Philly Fed reading? According to David Rosenberg it was so bad that it virtually guarantees a new recession:

“The Philly Fed index was the real shocker. Instead of coming at a +2 as the wonderful consensus was foreshadowing, it came in at -30.7. That is the second negative reading in the past three months, so with all the deference to the industrial production reporting of the other day, manufacturing looks set to contract. As the chart below illustrates, never before has the Philly Fed been at this level without there being a recession – will it really be “different this time around”? Well, Bill Dudley at the Fed seems to think so. Without going into the gory details, almost every component was negative – not just down, but below zero. This is a one in 10 event, and this breadth is itself consistent with a 90% chance of outright recession.”

Ouch.

Source: Gluskin Sheff

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.