“The United States debt, foreign and domestic, was the price of liberty. The faith of America has been repeatedly pledged for it… Among ourselves, the most enlightened friends of good government are those whose expectations of prompt payment are the highest. To justify and preserve their confidence; to promote the increasing respectability of the American name; to answer the calls of justice; to restore landed property to its due value; to furnish new resources, both to agriculture and commerce; to cement more closely the Union of the States; to add to their security against foreign attack; to establish public order on the basis of an upright and liberal policy; these are the great and invaluable ends to be secured by a proper and adequate provision, at the present period, for the support of public credit.”

Alexander Hamilton, 1790, First Report on the Public Credit

Those were the words of Alexander Hamilton in the First Report on Public Credit. When the United States was formed over 220 years ago we established a remarkable system whereby individual states were essentially provided with a framework within which they could operate as individual economies within a federal system. Virginians and New Yorkers were still Virginians and New Yorkers, but above all else they were Americans. I am not sure if they knew it at the time, but this integration of the states under a larger federal framework is what made the system work. And it has flourished ever since. In less than 230 years the USA has become the world’s largest and most prosperous economy. It’s truly a modern miracle of economics.

But what most Americans likely don’t know is that the USA is exactly analogous to the European Monetary Union. You see, within this fiscal union we call the USA, there are trade deficit and trade surplus states. This is just a matter of accounting. Because the states do such an enormous amount of business with one another there are, by definition, nations which export more than they import and vice versa. This is exactly the way it is in Europe. There are trade surplus nations and trade deficit nations. The only problem is, these nations are each expected to fend for themselves without the luxury of having their own currencies. This, as we can see, has resulted in a near catastrophic result.

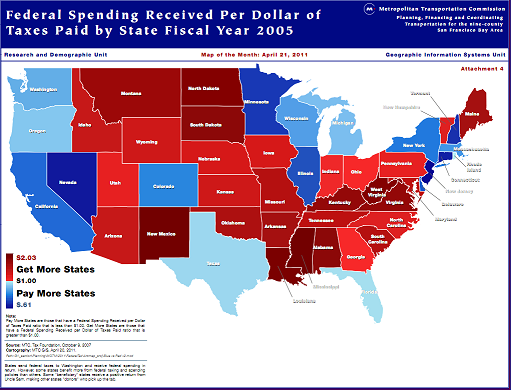

The key difference in the USA is that we have a supranational entity which allocates funds as needed. This allows the trade deficit nations in the USA to operate without going bankrupt every few decades. This can be visualized in figure 1. The chart below is based on data from the 2005 Census (so the data is obviously a bit old), but it shows the story of fiscal transfers in the USA:

Figure 1

Now, some organizations have used this information (such as the above chart) to make a political point (generally to point out that the red states are also the ones that claim to be fiscally conservative), but that misses the point. If you’re going to form a monetary union with a common currency, there is simply no other way to make it functional. The people who want to politicize this point are missing the bigger picture in the USA and ignoring the inherent accounting identities that are inevitable. Without these fiscal transfers the union would inevitably experience insolvency crises as trade deficit states were forced to finance their deficits via borrowed funds. This would inevitably cause insolvency crises, increased unemployment and slower economic growth. Just as we’re seeing in Europe.

And make no mistake, the story in the USA is awfully similar. After all, some states in the USA put Greece to shame (via The Economist – which prompted my writing of this piece):

“Europe still has a long way to go before it is as fiscally united as America. It could not contemplate anything like the transfers that America’s federal system allows. Take Virginia, for example. In 2009, according to the Census Bureau, the federal government spent $155.6 billion in this state where the revolutionary war was won. But the Internal Revenue Service collected only $58.6 billion in federal taxes. Virginia, in effect, ran a deficit of $97 billion. Indeed over the 20 years from 1990 to 2009, according to calculations by The Economist, it ran a cumulative deficit of over $590 billion.

That amounts to about 145% of Virginia’s 2009 economic output, similar to the debt-to-GDP ratio of Greece. If America were like the euro area, Virginia would have to bear the burden itself. But as part of a fiscal union, it can rely on others to help.

Virginia is not however the most “indebted” of America’s states, according to these calculations (see chart). That honour falls to New Mexico, which has a 20-year deficit worth over 260% of its GDP. Puerto Rico, which is a territory, rather than a full state, has an even bigger debt ratio.”

But you don’t hear northerners and southerners complaining to one another about New Mexico or Virginia. For the most part, we all accept the fact that we’re Americans and if one state undergoes extreme hardship, the other 49 pick up the slack to ease the burden. In doing so, it helps to improve the long-term prosperity of the entire union. As an economy, we are dependent upon one another, our banking systems are interdependent and one weak link in the chain increases the risk of overall hardship.

What’s happening in Europe these days is the equivalent of politicizing a chart like the one above. What they don’t seem to realize is that, because they’re involved in this monetary union, they’re only hurting the entire union by blaming certain states for the problems. Just like the USA, they are economically dependent upon one another and their banking systems are interdependent. The truth is, in any monetary union like Europe or the USA, deficits and surpluses are inevitable. And if you’re going to attempt to improve the economic welfare of these economies by creating a monetary union with a common currency then you have no choice but to create a supranational entity that can make fiscal distributions periodically.

What we see today in Europe is not liberty. It is far from it. Each European nation has ceded its monetary sovereignty to what is in essence a foreign central bank. And liberty cannot be achieved until an autonomous monetary state is established. And as I have said on many occasions during the Euro crisis, there are only two options in achieving liberty for Europe – you either complete the union or you dissolve it.

I still maintain that the European Union has the potential to be an economic force that China and the USA will struggle to compete with. But much like the union of the USA, these nations must confront their own issues of north vs south. Like the USA, I am confident that the Europeans will come out of this with the same sort of unity that resulted from the US Civil War. But if leaders in Europe are not faster to act, they might end up causing the same needless pain and suffering that the USA endured during the late 1800s when north and south could not agree. At the rate we’re going in the EMU, the price of liberty is likely to be high as leaders fail to understand the basic issues that they now confront and fail to get in front of them.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.