One of the bigger stories floating around today is Berkshire Hathaway’s big share buyback – the first time the company has done so. Warren Buffett has often been critical of Wall Street buybacks for one primary reason – he says Wall Street CEO’s too often buyback shares at elevated valuations and essentially destroy value for shareholders in doing so. His 1999 letter to shareholders nicely summarized his position here:

“it appears to us that many companies now making repurchases are overpaying departing shareholders at the expense of those who stay. In defence of those companies, I would say that it is natural for CEOs to be optimistic about their own businesses. They also know a whole lot more about them than I do. However, I can‘t help but feel that too often today‘s repurchases are dictated by management‘s desire to show confidence or be in fashion rather than by a desire to enhance per-share value.

…Sometimes, too, companies say they are repurchasing shares to offset the shares issued when stock options granted at much lower prices are exercised. This buy high, sell low strategy is one many unfortunate investors have employed but never intentionally! Managements, however, seem to follow this perverse activity very cheerfully.”

But Buffett has also stated that buybacks can be a fine use of company capital (via his 1984 letter):

“When companies with outstanding businesses and comfortable financial positions find their shares selling far below intrinsic value in the marketplace, no alternative action can benefit shareholders as surely as repurchases.”

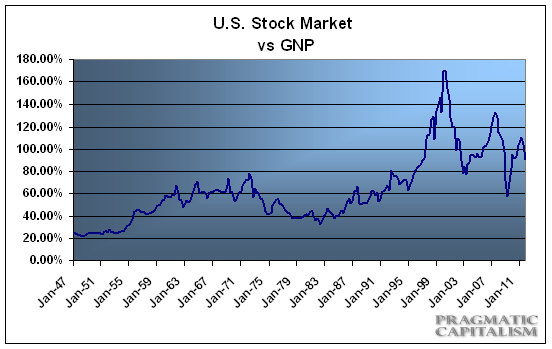

Interestingly though, Buffett has tended to find more value in outside companies. Hence, it makes sense that he has never repurchased his own shares. There were always better opportunities outside of Berkshire. But this buyback is telling us something interesting – Buffett can’t seem to find that “elephant” he has been so vocal about. And this all makes sense given his general view of market valuations. According to an updated version of his favorite valuation indicator, the market is still relatively overvalued (at 91% of GNP) when compared to the levels Buffett likes to be a buyer (below 80%):

So, I hate to read too much into this action, but given its uniqueness, I think we can make two broad conclusions here:

1) Warren Buffett believes Berkshire Hathaway is selling far below intrinsic value.

2) The rest of the equity market is just not that attractive right now in terms of relative value.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.