I’m continually baffled by the inability of economists to connect the dots on the causes of the financial crisis. This piece by Dean Baker essentially rejects the role of debt in the downturn, but Dean is clearly failing to connect the cause and effect and how debt rippled through the economy.

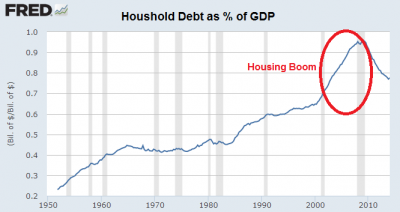

Of course, there were many contributing causes to the financial crisis, but housing played a particularly important role. And it was the extension of credit that helped enable what turned into a record boom in housing.

The story is not terribly complex:

- 1995-2005: Very loose lending standards and record high demand for mortgage debt led to an explosion in household debt.

- 2003-2007: The housing boom expands, residential investment booms, employment picks up and economic growth improves in large part based on the growing bubble in real estate prices.

- 2003-2007: Wall Street securitizes these loans and sells them thereby creating a multiplier effect based on the assumption that real estate prices won’t decline.

- 2006-2009: Real estate activity slows, price acceleration turns into deterioration, economic growth begins to slow before the contagion starts to spread through the financial system as deteriorating housing prices and economic activity begin to impact the financial system.

- 2008-2009: The financial system seizes up under the pressure of defaults and de-leveraging and Congress and the Fed enact their extraordinary measures to stop the bleeding.

- 2009-Present: The financial system slowly crawls out of a de-leveraging phase where a boom in household debt and financial system leverage preempted the collapse in real estate and the economy.

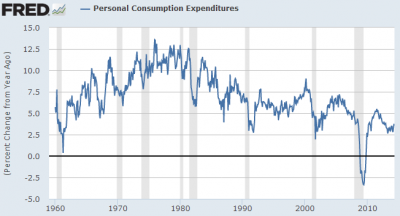

In his analysis, Dean Baker cites a chart showing personal consumption expenditures as a % of GDP and declares that PCE never really weakened. But this is an empty argument. It could just mean that PCE fell in relative terms to the fall in GDP and therefore has the appearance of not declining. Either way, this is the wrong way to measure the strength of PCE. A better perspective is this one which shows that something devastating happened to PCE in 2008:

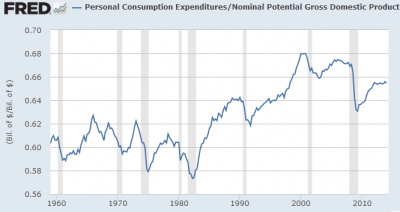

Or, if you don’t like that view you can take PCE as a percentage of potential GDP to see just how much PCE actually did decline:

Anyhow, I am not sure why so many economists reject this story. It doesn’t seem terribly complex to me and anyone who talked to Wall Street bankers before or during the crisis will tell you that this was what was really going on at ground zero of the financial crisis. Then again, most economists don’t even consider debt and inside money to be particularly relevant to the economy because they don’t seem to embrace endogenous money for some reason. So maybe that explains it, but probably not.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.