Interesting analysis here by RBC Capital Markets. In an article on Friday Bloomberg cited a report that says profit margins could come under pressure as revenues stagnate:

“Growing disappointment with U.S. companies’ revenue may be a harbinger of lower profit margins, according to Myles Zyblock, chief institutional strategist at RBC Capital Markets.

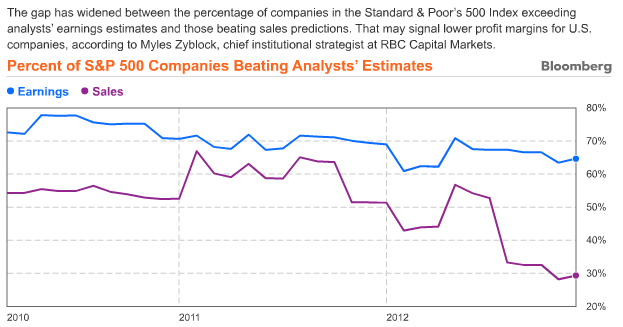

As the CHART OF THE DAY shows, the gap has widened this quarter between the percentage of companies in the Standard & Poor’s 500 Index that are exceeding analysts’ sales projections and those coming out ahead on earnings. The figures are based on comparisons with average estimates in Bloomberg surveys.

Fewer than 30 percent of S&P 500 companies are delivering so-called positive surprises on revenue, according to the data. The proportion has fallen from 52 percent a year earlier. S&P 500 earnings surprises have been more consistent, falling to 64.5 percent from 69 percent during the period.

“The heat is on for companies to preserve margins,” Zyblock wrote yesterday in a report. Their success will depend on pricing power, or the ability to raise prices without losing business, the Montreal-based strategist wrote.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.