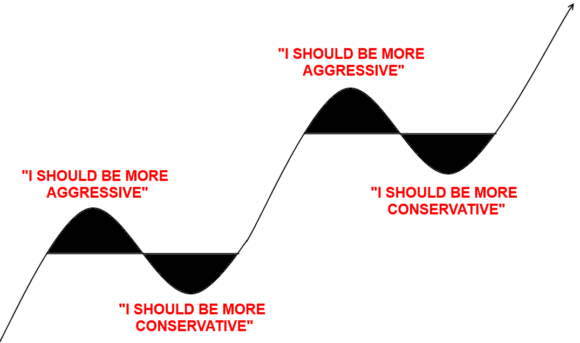

What a wild year it’s been. You could say that the pandemic was like an entire market cycle all rolled into one year. A boom, a bust and a boom.

In January I wrote the following piece about how to manage a crazy booming stock market and avoid the temptation to get overly aggressive.

Then just 3 months later I wrote this piece about how to manage a crazy collapse and avoid the temptation to get overly conservative.

But this is the battle we constantly wage with ourselves. Successful investing is mostly a battle between our ears and staying grounded when everyone else is losing it on the extremes. The key is, how disciplined can you remain through the boom, bust, boom and bust?

(The psychology of the stock market in one image)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.