At an operational level I actually find Quantitative Easing to be incredibly boring and not nearly as impactful or sophisticated as most people tend to think. After all, from the balance sheet perspective it just changes the existing composition of private sector financial assets. But as a behavioralist, I find QE enormously interesting because it carries with it some extremely intriguing bevhavioral side effects due to the way people perceive this extremely complex (and in my opinion, misunderstood) program.

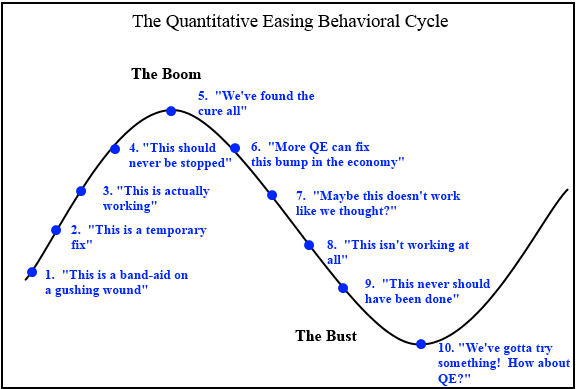

One thing that’s been interesting to watch is the cycle in how people have perceived QE over the course of the last 5 years. Of course, we’re not even through an entire business cycle yet, but we seem to be at a phase where market participants are now convinced that QE can fix just about anything. Speaking of which, I have a hole in my favorite pair of jeans. Do you think the local tailor knows how they can use QE to fix that?

Anyhow, it’s been fun to watch people’s perceptions change over the course of the last 5 years from pure skiepticism of QE to now viewing it as something that can permanently smooth out the business cycle. Of course, nothing can really smooth out the business cycle because the business cycle is dominated by the irrational emotions of apes who engage in that cycle, but that’s a different matter. But as we’re likely getting deeper and deeper into this cycle it will be interesting to see if delusions over QE’s efficacy turn into outright rejections of the program as it will, like all government policies, fail to permanently smooth the business cycle.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.