Greed has quickly turned to fear as our manic friend, Mr. Market, resumes his generally bi-polar behavior. The note below is a fear barometer courtesy of CitiGroup (via Business Insider). It is consistent with levels also seen in the AAII readings of late:

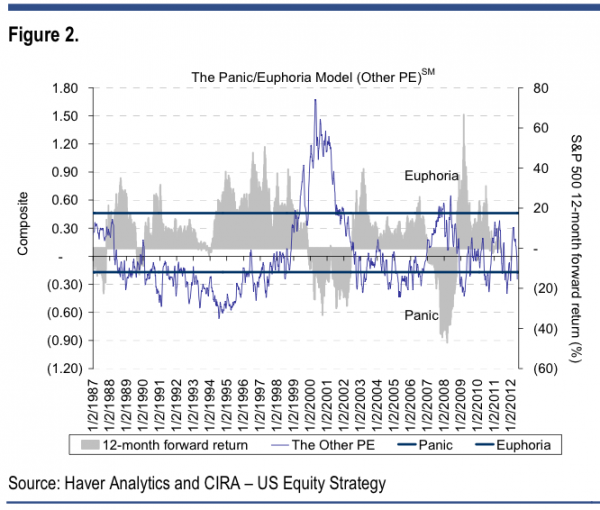

“Panic” resurfaces. Admittedly, markets rarely get that “cataclysmic crescendo of capitulation” to call for buying stocks, but proprietary measures such as the Panic/Euphoria Model now are intimating that upside opportunity has re-emerged. Meetings with institutional investors do not anecdotally demonstrate that people are “freaked out,” but the sharp decline over the past six weeks has caused significant deterioration of sentiment (even amongst credit investors). Other metrics still are not providing the requisite buy inflection such that a more positive view for stocks is appropriate but that nuance does not imply a willingness to grow long bull horns yet.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.