The Secular Stagnationists are growing in numbers. This breed of analyst and/or pundit looks a lot like the Permabear, but tends not to make specific market related calls. Instead, they tend to make broad macroeconomic calls. And the Secular Stagnationists think the US economy is in for a long bout of low or zero growth. I think there’s some merit to these ideas, but I also think there are some flaws in the underlying thinking.

The Secular Stagnationist clan has grown in numbers following the release of Thomas Piketty’s Capital. The book argues that economic inequality could lead to lower than normal growth. But there’s a substantial flaw in this thinking. Piketty also shows us that growth has been unusually high during the last 100 years. Since 1900 Gross World Product has averaged 3.8%. Since 1700 it has averaged just 2.1%. And over longer periods it’s even lower. Piketty argues that we’re headed back to the 1-2% range or closer to the average rate of growth of 2.1%. That’s bearish given the last 100 years of data, but not completely unreasonable. But more importantly, it means that the present era has been a secular boom. Therefore, if Piketty is right then we’re not entering a secular stagnation. We’re merely growing more in-line with the historical norm. A true “secular stagnation” would be truly abysmal growth of 0-1%. That’s not just bearish, but aggressively bearish. So there’s an obvious historical misrepresentation in the narrative of the Secular Stagnationists unless they all agree that growth is going to be negative or flattish.

In this paper by Eggertson and Mehrortra (via Krugman) they argue that deleveraging, a slowdown in population growth or an increase in inequality can contribute to this stagnation. They use Japan’s experience in the 90’s & 00’s as a benchmark for much of the work. Let’s look at each of these more closely and see how well this comparison fits.

First, I think there’s no doubt that a deleveraging puts enormous pressure on an economy since spending is a function of current income relative to desired saving. A deleveraging cycle reduces the value of saving since it puts pressure on asset prices and is likely to also reduce incomes. We have to be careful when comparing the USA to Japan or Europe here. Europe, for instance, is experiencing a broad deleveraging that is primarily the result of a dysfunctional currency union that is creating wage rebalancing because there is no external rebalancing mechanism (via trade or government tax redistribution). The USA, on the other hand, while not releveraging at a strong pace, is definitely not in a deleveraging cycle any longer. As I mentioned last year, the Balance Sheet Recession is over.

Second, stagnant population growth puts clear pressure on an economy. A lazy view of economic growth can be defined as:

Growth Rate of GDP = Growth Rate of Population + Growth Rate of GDP per capita

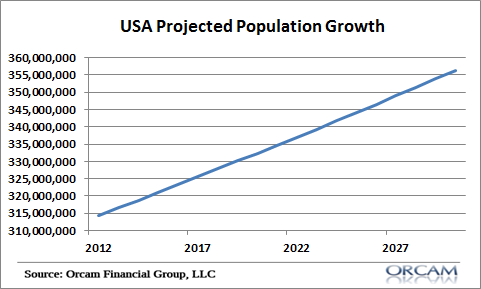

But again, we have to be careful about painting with a broad brush here. The USA is not Japanese in the sense of population growth. In fact, population growth is expected to be rather robust 13% in the coming 20 years:

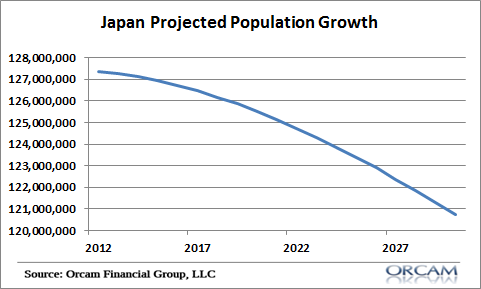

Now contrast that with the negative growth that Japan confronts:

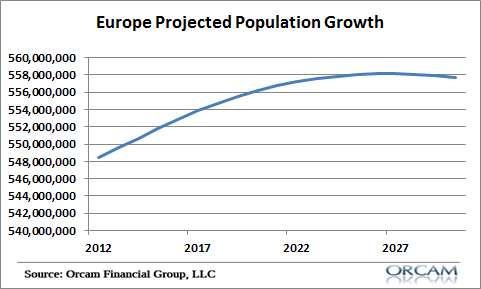

And then contrast that with the more modest 2% expected growth in Europe:

Clearly, the USA does not look very Japanese at all on this front. Europe, while not negative, certainly resembles something of a “stagnation” though.

The third claim about inequality is less clear. Piketty argued that inequality would lead to lower growth. But the data is very unclear on this relationship and much of Piketty’s own data is inconsistent. For instance, between 1950 and 2012 the growth rate on capital increased from 1.2% to 3.3%, but the global economy experienced its highest growth rate ever. So there’s no clear inverse relationship between inequality and economic growth. In fact, one could easily conclude that growing inequality contributes positively to economic growth. But more importantly, the Secular Stagnationists who also believe in inequality must still account for the aforementioned contradiction – growth moderating to 2.1% is not “stagnation”. It’s just the historical norm.

So the true Secular Stagnationists are those who believe growth will be negative or worse than 2% or so. And if you ask me, there’s no clear evidence that the USA is falling into that secular stagnation trap. In fact, the much more applicable case of secular stagnation appears to be across the pond in Europe where deleveraging and population growth appear to be much more significant headwinds in the coming 20 years.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.