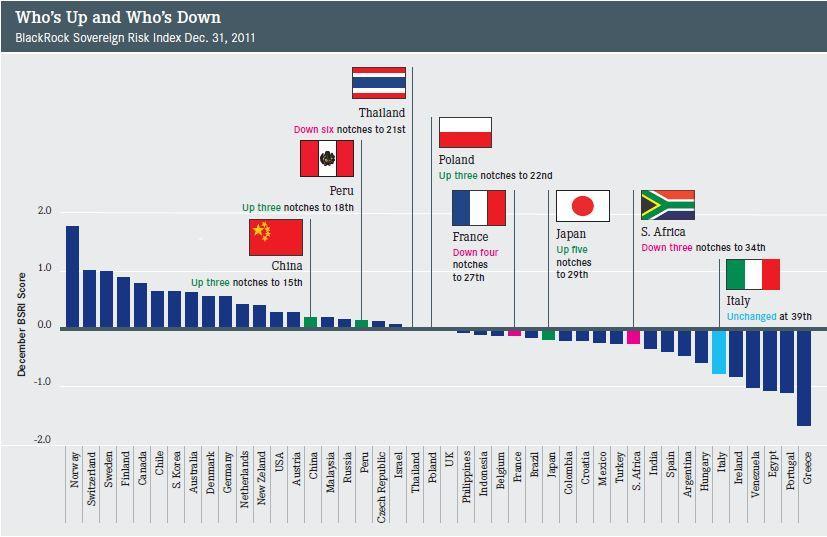

The Ishares blog recently highlighted the latest BlackRock Sovereign Risk Index showing where nations lie on the spectrum of riskiest sovereigns. The list is useful in better understanding the nations that one might prefer to avoid currently. Particularly useful for macro investors. The list shows most European nations at the riskiest end of the spectrum with the takeaway, in my opinion, being don’t bother considering investments in that region. Scandinavian nations sit at the opposite end (via BlackRock):

The BSRI uses more than 30 quantitative variables to track sovereign credit risk, complemented by qualitative insights from third-party sources. The index breaks down the data into four main categories that each count toward a country’s final BSRI score and ranking: Fiscal Space (40%), Willingness to Pay (30%), External Finance Position (20%) and Financial Sector Health (10%).

Fiscal Space includes metrics such as debt to GDP, the debt’s term structure, tax revenues and demographic trends such as dependency ratios. Willingness to Pay measures a government’s perceived effectiveness and stability as well as factors such as corruption. External Finance Position includes exposure to foreign currency debt and the state of the current account balance. Financial Sector Health gauges the strength of the banking system and the risk of credit bubbles. For complete descriptions, please see “Introducing the BlackRock Sovereign Risk Index.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.