Does money really buy you happiness?

The opening quote in my new book is:

“The person who mistakes “money” for “wealth” will live a life accumulating things all the while mistaking a life of owning for a life of living.”

Although my book is all about understanding money, investing and the economy I tried my best to highlight what I think is one of the most important elements of understanding our monetary system – while money is important and necessary in this system it should not be viewed as the ends when it is merely a means to an end.

I got to thinking about this in more detail this weekend as I was reading this piece in the FT which discusses how greater wealth is indeed linked to greater happiness. I don’t think this is necessarily wrong, but I would argue that greater wealth has a diminishing rate of return with regard to how effectively it can contribute to our happiness. As of 2010 the rate of return tends to decline after earning about $75,000 per year according to this Princeton study.

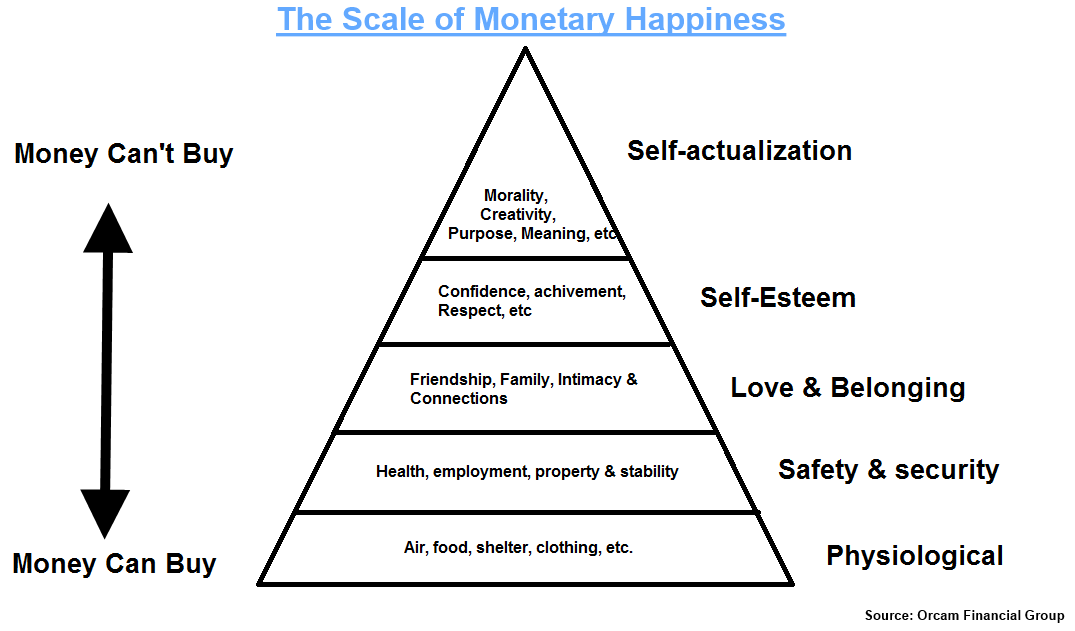

In order to conceptualize this I took Maslow’s Hierarchy of Needs and applied it to a spectrum showing that the higher up the hierarchy you go the less effective money is in helping you attain certain things.

Money is obviously a necessity because we all need things at the bottom of the hierarchy. But as you climb higher you find that money has a diminishing rate of return in helping you acquire those things. Money cannot buy you morality, purpose, meaning or many of the things that are higher on the scale.

So, does money buy you happiness? Money can buy you a certain level of happiness and there is little doubt that money makes life easier in many ways. But money cannot buy what might be seen as the ultimate forms of happiness. That includes things like purpose, meaning, friends, family, etc. So don’t confuse the means with the end. Doing so will warp your perspectives on what matters and what doesn’t.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.