There’s been a lot of chatter in recent years about the idea of secular stagnation. That is the idea that we’re in a prolonged period of sub-par economic growth. The idea gained a good deal of attention in recent days thanks to a new book from VoxEU on the topic. The authors are a who’s who of economics including Krugman, Summers, Eichengreen, Blanchard, Eggertsson , Koo and many others.

I think it’s important to keep this topic in perspective though. Yes, we’re in a period of sub-par growth. But how sub-par is is this growth in historical perspective? The following chart is from Thomas Piketty’s Capital, the groundbreaking book on wealth inequality. One of the points I highlighted in the book earlier this year was Piketty’s idea that wealth inequality was likely to hurt future growth. I pointed out that this idea wasn’t supported by recent economic data. In fact, during the periods when the return on capital was highest the rate of growth appeared to accelerate.

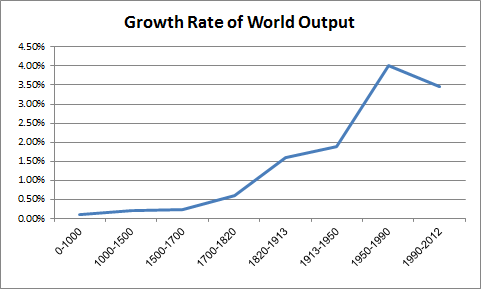

Anyhow, when we look at historical growth in global output we see a clear trend. And recent history has been a period of incredible growth. The period from 1950-1990 was the highest on record. The period from 1990-2012 was lower than the 1950-1990 period, but still substantially higher than any period before that – by a huge margin.

So yes, we might be in a period of sub-par growth relative to the 1950-1990 period. But when you look at the long-term trends in place you can see that we’re actually still far better off than we were just a lifetime ago. Sure, things aren’t as good as they were just a few decades ago, but they aren’t anywhere close to being as bad as they were several centuries ago. We live in a period of incredible global expansion and output. We shouldn’t lose perspective here just because the current decade isn’t quite as strong as recent decades.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.