I don’t predict monthly payrolls reports. And frankly, anyone who does is just throwing darts in the dark. But plenty of analysts do it on a monthly basis and when someone ends up close we see them paraded around TV like they’re some sort of genius. I don’t think anyone can accurately predict the monthly payroll reports. There are too many moving parts and too many unknowns to accurately predict such a number.

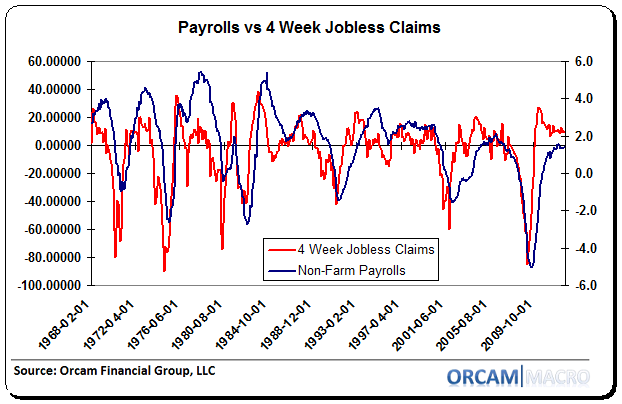

But one thing we can do is get a very accurate idea of the macro trend in the overall data that will help formulate a better idea of the general economic trend. To me, we get that data every single week in the form of jobless claims. And if we take an inverted year over year look at claims you’ll find a remarkably close correlation with payrolls. In fact, claims lead the payroll data by just a bit.

The latest reading in claims showed a very slight downtick in year over year change. But it’s basically been flat for the last quarter and it’s certainly not declining (or rising if we’re not inverting the data). So what does it all add up to? Not a specific number. That’s for sure. I don’t know if we’ll be over or under tomorrow’s collection of analyst guesses. But the weekly claims data is telling us something very specific about the labor market. It’s not doing much on the downside or the upside. And to me, that means more of the same sluggish kind of labor and general economic reports that we’ve been seeing for a long time now.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.