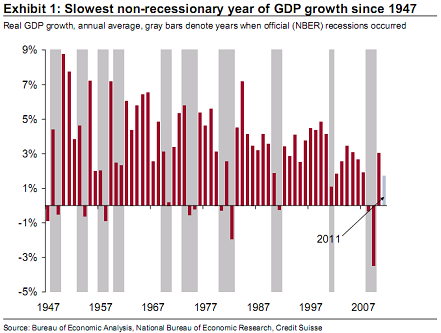

I know it’s all the rage to be super optimistic about the economy right now, but as one of the few people who cited double dip fears as vastly overblown last year (when many were calling for renewed recession) I think it’s important to maintain some perspective here and not get overly excited about the sort of growth we’re experiencing. Yes, the economy is NOT slipping back into recession, but growth is also very weak. In a recent note Credit Suisse does a nice job of highlighting the macro picture here with an emphasis on the weakness of this recovery:

• Economic performance improved in the final quarter of 2011. But the year overall was the slowest non-recessionary year of GDP growth since 1947 – hardly cause for a victory lap.

• Recent data make us more secure in our belief that the expansion will persist unimpeded in 2012. We remain skeptical that a new phase of sustained faster growth is upon us. We still expect 2012 GDP growth at 2.2% on a Q4/Q4 basis (2.3% annual average).

• In our last forecast review, we cited risks around that forecast as being titled to the downside. Risks appear more balanced now, due in no small measure to the ECB’s three-year long-term refinancing operation, which has reduced financial stress and the risk of a systemic panic in global financial markets. Reflecting more positive recent developments, our recession probability model has fallen to virtually zero from a local high of 35% in September 2011.

• The economy shows symptoms of a slowdown in potential GDP growth. The fact that the economy has not managed a single quarter above 3% since the early stage of the recovery is telling in itself. This may reflect structural change as much as cyclical disappointment.

Source: Credit Suisse

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.