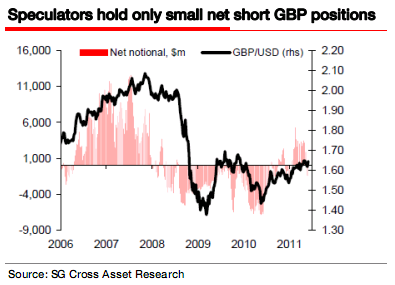

Forex analysts at SocGen see a continued decline in the Pound Sterling versus the USD since its peak in early May. They say the weak UK economy, potential for more QE, continuing data misse and easy monetary policy by the Bank of England will likely continue to exert pressure on the currency:

“ECONOMICS: IMF gives seal of approval to UK fiscal policy. With a very weak (misleadingly so) manufacturing PMI last week and then an onslaught in the weekend press against the government’s fiscal plans, it was highly fortuitous that the IMF report was published at this time.

RATES: QE is back in the press. We do not question the possibility that conditions could become so unfavourable that the economy might need an extra something, but would humbly suggest that if so, QE is not the answer.

FOREX: Sterling stumble should continue. The GBP remains one of the weakest currencies in the G10, and another major week of tough data hurdles lies ahead. This week’s macro focus offers further GBP hurdles. Money markets no longer price in a rate hike this year by the BoE.”

Source: Soceiete Generale

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.