As I’ve noted elsewhere, the government’s deficit and the surge in business spending (primarily dividends and investment) have been the key drivers of the economic growth as well as the corporate profits boom. But with the budget deficit now declining the burden is falling increasingly into the hands of corporations as consumers remain fairly weak and the foreign sector contributes a net negative. So what’s the outlook here? Will corporations actually continue to spend? In a recent note, David Rosenberg highlights what he calls the “strongest case for capex” (via Business Insider):

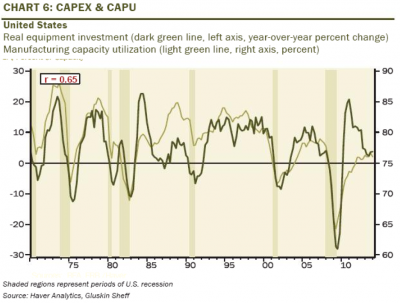

“The answer lies in CAPU … in other words, capacity utilization rates. While hardly yet at a peak, at 77% for U.S. manufacturing they are at levels that in the past touched off a moderate capex growth cycle. As the chart below shows, there is a slight lag but a decent 65% historical correlation. History also shows that once 77% is breached in terms of CAPU rates in an up-cycle, capital spending in real terms in the ensuing years averages out to be 0% growth — enough to add an increment 60 basis points to headline GDP trends.”

This also ties into why I think it’s important for the Fed to keep rates low. The wrong signals to businesses could result in a tightening in purse strings and put an end to the corporate borrowing binge we’ve seen over the course of the last few years. That’s the last thing we need right now.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.