In a recent post I talked about the intertemporal conundrum, the problem of time in a portfolio. That is, we live in a dynamic world where our financial lives aren’t necessarily one clean “long-term”. Because of this we often obsess over the short-term and end up doing detrimental short-term actions in what is essentially a failed attempt to create certainty in an uncertain financial world. It isn’t totally irrational to think about the short-term, however, this article from Fund Reference shows just how bad the problem is.

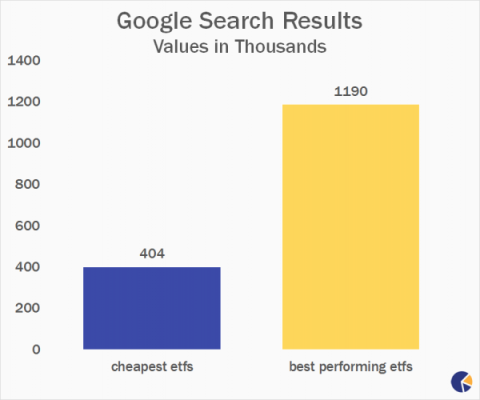

Here are just two examples of how bad the current state of affairs is:

That is even worse than I would have expected. For every person who is thinking about the “long-term” there are almost 20 who are thinking about the “short-term”. And the chart on expenses relative to performance shows that we’re basically just chasing performance and downplaying the importance of fees. Yet the data shows this is precisely the wrong way to think about the financial markets. Yes, we’re all active investors. But the smart active investors maximize efficiencies by reducing portfolio frictions like taxes and fees while maintaining a realistic perspective of your investing time horizon. The obsession with the super short-term is almost certainly detrimental to your wealth.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.