I don’t often give Ben Bernanke a lot of credit for the job he’s done. I am admittedly hard on him and perhaps unfairly so. But he deserves some serious credit for his persistent comments on inflation in the last 24 months. Dr. Bernanke was mercilessly mocked in some circles for calling the surging commodity prices following QE2 “transitory”. In early 2011 he was cited:

“I think my take on inflation right now is that we are indeed seeing some increases, obviously,” Bernanke said. He attributed them to “global supply and demand conditions.” But he reckons these prices “will eventually stabilize.”

“I think the increase in inflation will be transitory,” Bernanke said. But we added: “we have to monitor inflation and inflation expectations extremely closely because if my assumptions prove not to be correct than we would certainly have to respond to that.”

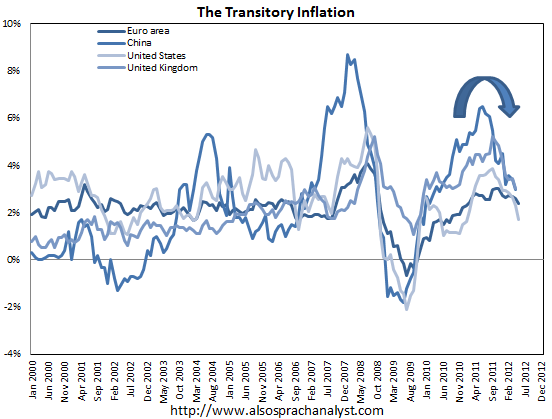

He was further mocked by some who said the inflation would prove global in nature and that the impact would eventually spread to the USA. But this excellent chart below from Also Sprach Analyst shows that Ben Bernanke was very right about inflation. He deserves a great deal of credit for his prescience on the inflation front.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.