For years now I’ve been working under the Balance Sheet Recessionary theory – the idea that the private sector has experienced an unusual slump due to a debt based bubble that impaired balance sheets and slowed aggregate demand to a crawl. In such an environment the private sector cannot sustain growth because spending is diverted towards balance sheet repair – spenders become savers. This is inherently deflationary if it plays itself out naturally. But clearly, that’s not what occurred. Instead, the government stepped in and picked up the slack.

In order to visualize what’s happened in the USA it’s helpful to take a step back. The following charts will help communicate the above concept.

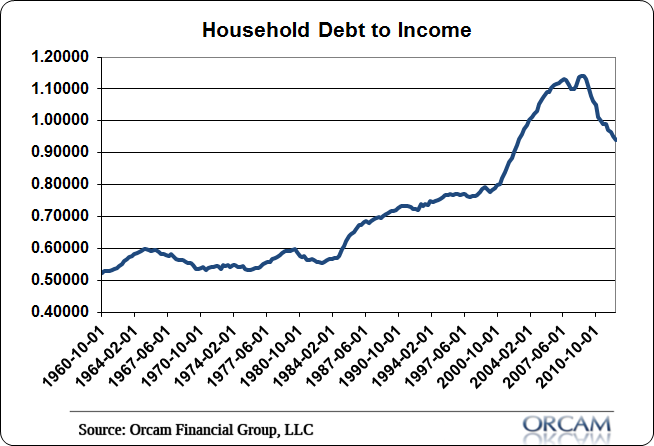

Stage 1: Private sector debt bubble and inevitable implosion.

That big surge in the ratio from 0.80 to 1.15 is the result of the housing bubble and the irrational exuberance over the idea that housing prices cannot go do down. The subsequent decline has been the result of the de-leveraging cycle.

It’s led to healthier balance sheets, but the process has coincided with very weak aggregate demand and a sluggish overall economy as a result.

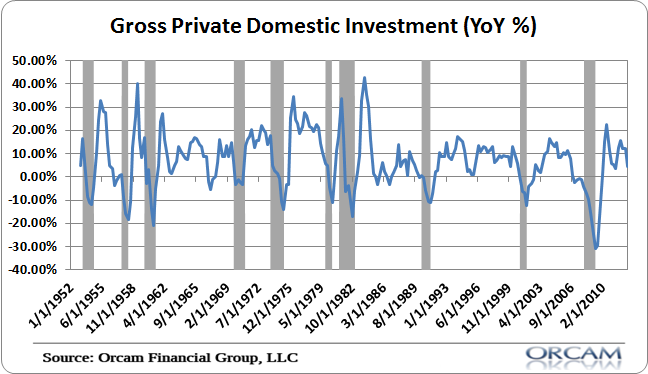

Stage 2: Private Investment Collapses Bringing the Economy to a Screeching Halt.

The US economy normally ebbs and flows with private investment. Private investment has always been the lifeblood of the US economy, but when the housing bubble burst it took private investment down in a way that was unprecedented with declines over 30% year over year.

Stage 3: The government steps in. Did they rescue a dying patient?

When the private sector collapsed in this unprecedented way there were a few options. We could have done nothing and just let the bubble collapse play out naturally. This likely would have resulted in a far deeper and potentially more prolonged depression. What’s going on in Greece and Spain is closer to this scenario and those nations have full blown depressions with continually declining GDP and unemployment well over 20%.

The other option was to use the government to improve balance sheets. This was achieved in part via QE1 and the Fed’s various lending programs which helped bring some semblance of normalcy to the markets and helped bolster bank balance sheets. It’s my opinion that QE2 & the QE^n’s have been less impactful, but none impactless (though I do worry that the risks outweigh the rewards).

The other big help was the government’s budget deficit. As you can see in the chart below the private sector experience a massive surplus position as a result of the government’s deficit. Remember, when the government deficit spends Peter buys a bond from the government, the government deficit spends Peter’s bank deposits into Paul’s account and Peter ends up with a t-bond. The t-bond is a net financial asset for the private sector because there is no corresponding private sector liability attached to it. (See here for more on this).

In a balance sheet recession deficit spending serves like a double dose of stimulus. Not only does it increase the flow of spending in the economy, but it also improves private balance sheets by providing the private sector with a risk free asset that has no corresponding private sector liability. We can quibble over the efficiency of the government’s “flow” (deficit spending), but we can’t really argue with the accounting.

Stage 4: Where do we go from here?

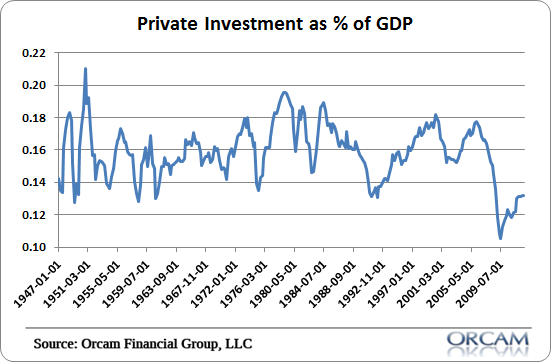

Understanding the balance sheet recession and the economic recovery has been all about understanding the process of de-leveraging and balance sheet improvement. And the budget deficit has been, arguably, the key component to all of this. So, looking ahead, the deficit continues to play a key role. As private investment picks up the slack and the private sector starts to run with the baton the government’s deficit becomes less important.

The problem is, we’re not close to being out of the woods. The economy might being starting to feel a bit better, but the reality is that it’s still quite weak. Yes, the de-leveraging has started to turn into a re-leveraging, but that’s just the beginning of a normal healing process. And private investment is still lower than its been at any point in the previous recessions.

Goldman Sachs estimates that the budget deficit is set to come in at $775B this year. That’s down from their earlier estimate of $900B and way off the consistent $1T+ deficits we’d seen in previous years. But it’s still a rather large budget deficit at about 5% of GDP. We were at risk of experiencing much larger cuts. Still, this will likely impede growth going forward as the reduced deficit works against two trends – it reduces the flow through the economy that is still on life support AND it reduces the additional net financial asset contribution which has played a crucial role in the balance sheet repair process. These are not good developments, but they’re also not going to send us into a Greek-like scenario. In short, it looks like muddle through is probably here to stay.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.