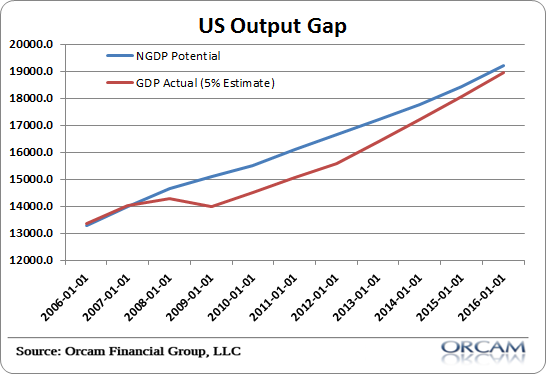

If we take a look at the output gap in the USA we can obtain a far better understanding of the hole that the Great Recession put us in. Here are some of the ugly facts about the US economy:

- The output gap peaked in 2009 putting us in a $1.1 trillion hole or about 8% of GDP.

- The current output gap of $1.06T is roughly 6.82% of GDP.

- The US economy has averaged 4.6% nominal GDP growth since 1990.

- The US economy has averaged 3.8% nominal GDP growth since 2000.

- In the last 3 years the US economy has averaged just 3.7% nominal growth.

- In order to eliminate the output gap entirely the US economy would need to grow at 5% for the next 5 years.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.