Joe Weisenthal recently asked for a recommendation for a good gold analyst to interview on Bloomberg. I said:

@TheStalwart There are no good gold analysts.

— Cullen Roche (@cullenroche) April 21, 2016

I was sort of kidding, but let me explain.

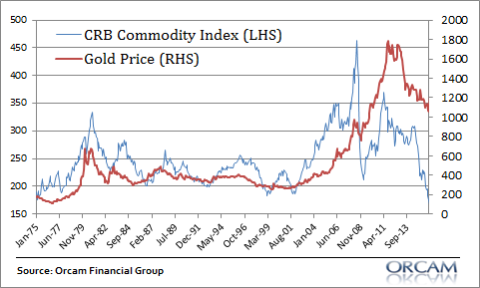

Gold is one of the most interesting assets because it is viewed by many people and even central banks as a form of “money” or insurance. As a result of this it tends to have a uniquely special place in the financial system since it is a commodity as well as a form of money/insurance. What’s interesting about all of this is that gold’s price has earned a huge premium over the CRB Commodity Index in the last 40 years:

Explaining this price premium is a bit of a conundrum. After all, gold isn’t even a very useful commodity, however, due to the embedded demand due to its other properties, its price has boomed over time. I have referred to this price premium as a “faith put” due to the belief that gold is a form of money and insurance. But to be honest, I really don’t have a good explanation for this premium other than that. There have been other good attempts to explain gold’s pricing (Barsky and Summers on the Gibson Paradox is very good, for example), but I can’t say that I find many of them to be all that convincing.¹

Based on my knowledge of the monetary system and the capital markets I tend to agree with Warren Buffett here.² In essence, gold is a cost input in the capital structure and does not, in and of itself, generate anything productive. This means it is little more than another commodity and should not earn much of a premium in the long-term outside of its productive use. Further, I have argued that while gold is money, it is not a very good form of money since it is such an inconvenient medium of exchange (I suspect this will become even increasingly apparent as technology renders physical monies irrelevant). And I would further add, in addition to being an inferior inflation hedge versus stocks, gold doesn’t serve as a very reliable fiat currency hedge since, if the fiat currency system goes away you’ll wish you’d invested in lead and not gold.

Of course, my opinions are just one among many and the obvious consensus is that many many people believe gold is a valuable asset above and beyond its use as a commodity. So, either I am the very worst gold analyst or I am the very best gold analyst who’s just very early to the trade.³

The lesson? Be wary of anyone proclaiming themselves to be an expert analyst about the future price of gold. I suspect no one can accurately and consistently explain why it performs the way it does….

¹ – See, Gibsons’s Paradox and the Gold Standard

² – See Warren Buffet in Fortune, Why Stocks Beat Gold and Bonds

³ – Remember, there are no good gold analysts, especially not me.

Related reading:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.