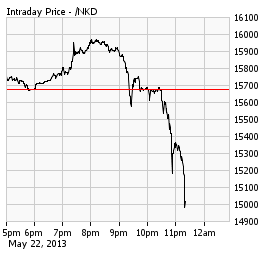

Another reason why it’s important for people to start thinking about secondary markets as saving and not investment. When your accumulated savings starts swinging 7% intraday it makes it hard to plan for life….For those who likely aren’t watching, the Nikkei Index has done just that – an intraday move of almost -7% from its highs.

For the sake of the Japanese people I hope this isn’t the beginning of an insane rollercoaster ride, but I do fear that such blatant central bank manipulation is likely to end in just that – more volatility in people’s savings. I guess we can debate whether that’s a good thing or a bad thing, but I still maintain that this is highly irresponsible policy no matter how high the central bank can jam prices.

We’ve been through too many booms and busts in the equity markets to have not learned how damaging this sort of volatility can be and any central bank who directly contributes to that volatility should really be ashamed for having learnt so little from recent history….

Update: this was just the beginning. The Nikkei 225 closed 7% lower. The index saw a 1500 point swing intraday or almost 10%. How’s that for creating economic stability?

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.