Is it just me or has there been a resurgence in the number of people who worry about hyperinflation? I don’t engage in these conversations too often anymore because they’re almost always the same. That conversation usually goes something like this:

Inflationista: The government has destroyed our purchasing power by printing too much money!

CR: You know, the US government doesn’t really print money the way you think. (see myth #1).

Inflationista: Yeah, but how do you explain why our living standards are collapsing and the value of the dollar is cratering?

CR: The dollar has fallen in real terms, but median wages are up 32% since 1975. Americans spend less on necessities today than they ever have. Just look at the CPI data!

Inflationista: That inflation data is fake! You should use Shadow Stats instead.

CR: Bwahahahahahaha.

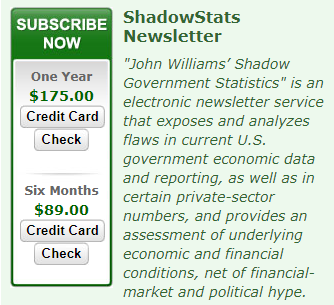

I’ve pointed this out a few times over the years (originally in 2011 and then again in 2014), but it gets better every year. You see, Shadow Stats was one of the most vocal pumpers of the hyperinflation narratives over the years. And as the hyperinflation failed to materialize so too did any inflation in the cost of a Shadow Stats subscription:

It’s crazy. If there was high inflation then there would almost certainly be rising demand for hyperinflation services. But the exact opposite has happened. The price has deflated despite a rise of 25% in the CPI since 2006 when the first screenshots are available. In other words, the best indicator of low inflation comes from the very people who sell services based on hyperinflation happening.

Anyhow, it might sound like I am just trolling, but I am not really. I don’t care that most of these people are selling a political narrative. What bothers me is that they have the operations and first principles all wrong. They misunderstand inflation because they think that the government prints money and that QE wrecks the US Dollar. All of which is operationally wrong or at least misleading. And it’s important stuff because if you understand the first principles better then you can avoid the minefield of bad narratives out there that lead to misinformed decisions. The hyperinflation narratives are ground zero for misinformation and it’s why hyperinflation subscription services have no pricing power.

Related:

- Shadow Stats Debunked,

- Addressing misconceptions about the Consumer Price Index, Monthly Labor Review, August 2008

- Other critiques of Shadow Stats

Update: Shadow Stats has been officially debunked. Turns out the whole thing was based on a basic math error.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.