This Bloomberg piece about hedge funds created quite a stir today. The basic gist of the article was – hedge fund performance is bad and they charge high fees which makes them really bad. It’s easy to jump on this bandwagon, make a bunch of oversimplifications and come to the populist conclusion that hedge funds are just a “compensation scheme masquerading as an asset class”. The reality is much more complex though and the whole idea of “hedge funds” has become a rather nebulous concept.

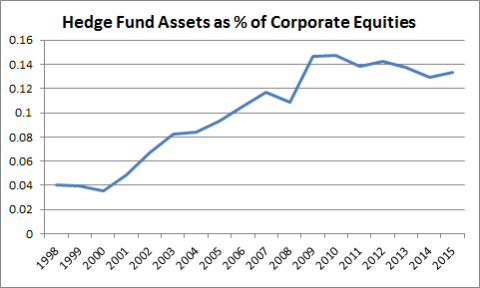

Traditionally, we could easily bunch “hedge funds” into a nice neat little bucket. For instance, back in the days of Buffett Partners a “hedge fund” was basically a multi-strategy long only fund with a unique tax structure relative to other long only funds. That was pretty easy to size-up and compare relative to a public benchmark like the S&P 500. But the hedge fund industry has expanded as a portion of outstanding corporate equities since then from nearly nothing to a fairly sizable chunk of the market:

But what “market” do these funds now represent? We really can’t say without generalizing to some degree. After all, “hedge fund” today can mean “high frequency trader”, “market neutral”, “market maker”, “liquid credit”, “private equity”, “shadow bank”, “activist”, distressed credit”, “fancy pants macro”, “pretty rock real assets” or anything you wanted to call it. In other words, properly benchmarking and evaluating the performance of these entities is practically impossible. And that’s what makes studies like this one, which finds that hedge funds are stinkers, pretty useless.

More importantly, a lot of the strategies discussed above are probably fairly valuable for certain firms and even the average investor. For instance, market making, which is what many large hedge funds now do, is basically a market neutral active management approach that charges a fee to do what passive investors refuse to do on their own (make an active liquid market in underlying instruments). In fact, one of the things that makes passive ETFs so fantastic is the fact that a fee charging active manager is helping to make their passive dreams come true!

Somehow we’ve arrived at this strange reality where the investors who make passive indexing possible are maligned on a consistent basis by anyone and everyone. There’s a certain hilarious irony in seeing efficient market cheerleaders bash an industry that is growing by leaps and bounds as if to argue that the market is actually inefficient. It makes one wonder if the passive investors understand how dependent they are on the active market participants (or if they understand that the line differentiating them is very, very blurry)….

Of course, this isn’t me apologizing for hedge funds. I am fairly certain that the vast majority of investors have no business allocating their assets in anything that resembles a “hedge fund”. And I am almost entirely certain that most long only or properly public equity benchmarked “hedge funds” don’t deserve the moniker and are just charging high fees for something fancy sounding.

And let’s be honest – at the end of the day the average mom and pop investor is just looking to allocate their assets across a fairly safe pool of liquid assets that won’t blow them up in a crisis and won’t erode their purchasing power. Low fee index funds will suffice for 99% of the public looking to achieve these fairly basic goals. But I do think we have to be a bit more careful with how broadly we paint with our “hedge funds are bad” brush.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.