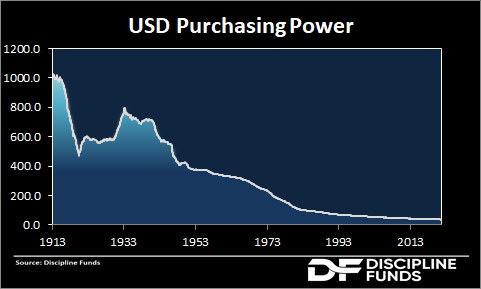

Every so often this chart of the US Dollar’s collapsing purchasing power starts making the rounds. It’s usually promoted by gold standard advocates or “sound money” advocates. And yes, it’s true that the USD has lost 96.4% of its purchasing power since 1913 (as of October 2021).

The flaw here is this chart is a misrepresentation of the real investment and output denominated in the Dollar. While this chart implies a declining living standard and reduced real wealth, the reality is the exact opposite.

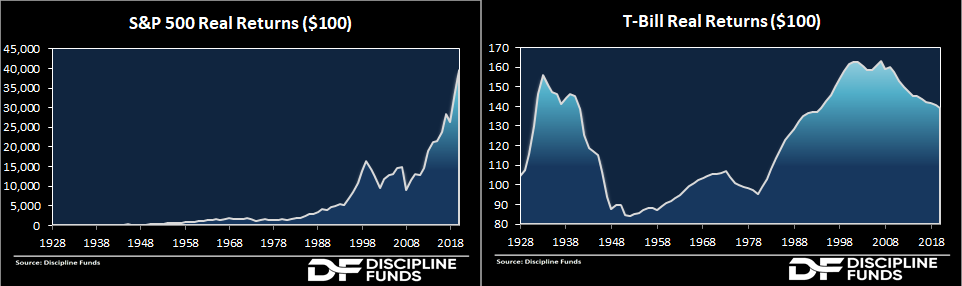

Households don’t leave their dollars under their mattresses. Households invest dollars in instruments that earn cash flows from the real investments that we make in the country. In fact, a household that held just T-Bills maintained their purchasing power through interest payments alone. A household that purchased the real output of US Stocks grew $100 to over $40,000 since 1928 (using first date of reliable historical data). In other words, if you held all of your money under the mattress you did quite poorly. If you diversified across even just T-Bills you maintained your purchasing power. If you invested in the real output of the US economy by owning real assets like stocks you did unbelievably well in real terms.

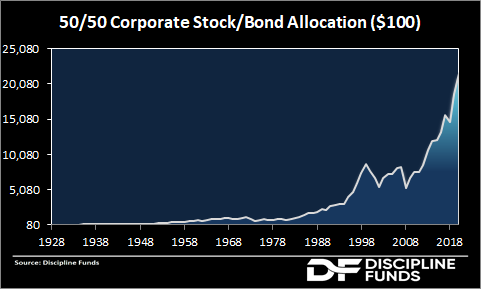

If you had diversified your portfolio across 50% corporate bonds and 50% stocks you would have grown $100 into $21,500.

As you can see, these charts tell a dramatically different story about the well-being of US Dollar denominated assets when compared to cash dollars. Of course, these charts don’t even consider the fact that most people earn an inflation adjusted income over the course of their lives while their savings grows.

Consider these other facts since 1913:

- Household net worth in the USA is the highest in the world.

- US Real GDP is the highest in the world.

- US Median Real Income ranks 5th in the world.

- The median income earner in the USA is in the top 1% of global earners.

More recently we hear that something horrible happened in 1970 when we left the Bretton Woods system. But this too is misleading. $100 invested in US stocks in 1970 is worth $16,670. Inflation adjusted hourly wages are up 65% since 1970. More broadly, living standards have exploded higher by most metrics over this time period.

Does this sound like a situation where the Dollar has served the US economy poorly?

This data is also consistent with global wealth and income trends according to Branko Milanovich. Hyperinflationsts like to claim that the USD has lost 99% of its purchasing power, when, in fact, the average American earns 50X what the global poor earn. In global terms, the average American is in the top 1% of wealth and income. Not only has the Dollar not been debased over this period, its citizens have enjoyed an unmatched period of prosperity, wealth and income generation. The idea that Americans have suffered at the hands of the US Dollar fiat system is not only factually wrong. It’s preposterously misleading. But yes, if you never work during your life and also choose to hold all of your savings under your mattress in the form of cash then you will suffer a horrible loss of purchasing power over your lifetime.

Now, there’s a reasonable argument that the USA could be even wealthier than it is today had we implemented some sort of more stable or “sound money” currency. This sounds an awful lot like someone who looked at Michael Jordan’s career and concluded “if only he’d practiced a bit more – imagine how great he could have been”. It seems difficult to argue with the economic outcomes of the USA when living standards and economic outcomes have been phenomenal across so many metrics when compared to the early 1900s. This is not to imply that everything is perfect, but objectively speaking, the US economy is far better off than it was in 1913 or 1970.

NB – I am not arguing that inflation is necessarily good. It can be extremely harmful in many ways and we should be mindful of the many ways in which our government can destroy purchasing power, but these “death of the dollar” narratives always exaggerate the issue.

Related:

- The Myth of Declining American Living Standards

- Pragmatic Capitalism: What Every Investor Needs to Know About Money and Finance

- The Biggest Myths in Economics

- Understanding the Modern Monetary System

- Hyperinflation: It’s More Than a Monetary Phenomenon

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.