I keep hearing and reading all these stories about how there’s now a crushing “fiscal contraction” in the USA. But is that really true? Not according to the data. Here’s what the CBO projects in the coming 4 years with regard to federal outlays:

2012: 3,537

2013: 3,455

2014: 3,600

2015: 3,777

2016: 4,038

2017: 4,261

And then here’s actual current expenditures at an annualized rate – you’ll notice it’s actually up year over year though only marginally:

2013:Q2: 3,817.8B

2012:Q2: 3,787.9

Federal spending is obviously not falling even if the deficit is. Anyhow, the confusion seems to be the way some people are viewing the deficit. Remember, the deficit is government spending in excess of taxation. When the government runs a budget deficit they sell a bond to Peter who gives the government his bank deposits and the government spends those bank deposits into someone else’s bank account. Peter gets a bond which is a net financial asset for the private sector (ie, it has no corresponding private sector liability).

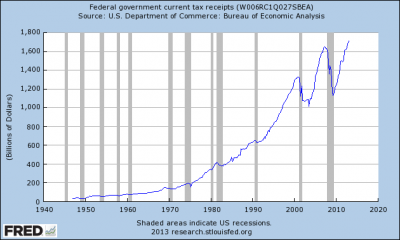

So, why is the deficit falling this year if spending isn’t contracting all that much? The main reason is tax receipts. While federal spending is flat year over year the amount of tax receipts are up 6% as of Q1 and likely up even more than that when we see the Q2 data.

What does it all mean? It means the government is still spending the same amount as it was last year, but they’re issuing FEWER financial assets as t-bonds because tax receipts have increased. From a flow of funds perspective the government is still firing the economy full of spending. From a balance sheet perspective you could potentially argue that the reduction in net financial assets is not helping to support a still weak debt-laden consumer. But I would be careful about rushing to believe the “USA austerity” crowd. They’re not telling the full story.

Related:

Stop with the “Money Printing” Madness

Understanding the Modern Monetary System

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.