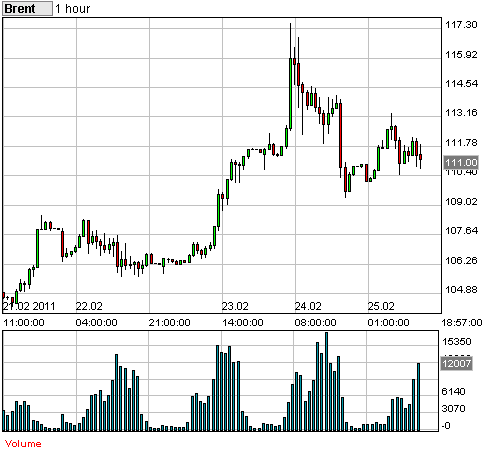

The markets became slaves to oil prices this week as fears of Middle East contagion sent prices skyrocketing almost 20% higher in 5 days. After nearly breaching the $120 level in overnight trading on Wednesday Brent Crude made a dramatic reversal before settling almost $10 lower just hours later. Brent crude is now sitting at $111 – almost 10% higher for the week. Thursday’s big reversal had all the hallmarks of a capitulation move, however, one has to wonder if oil prices won’t continue to linger over the markets as we enter the early part of the seasonally strong summer driving season. Ultimately, the endgame is in gasoline prices and with continued QE, a modest economic recovery and the likelihood of continued turmoil in the Middle East you can’t help but wonder how the consumer is going to escape higher gas prices this summer….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.