Okay, I promised I’d offer some bearish views after offering my bullish views yesterday. It’s always nice to challenge your own views so going through this was kind of a nice exercise. I hope these two posts offer some perspective.

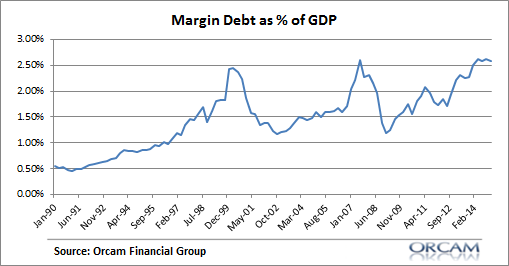

1) Margin Debt as a % of GDP is back at dangerous levels. We know that debt can be an extremely dangerous component of any economic boom. After all, it’s usually the excesses of the boom that lead to the bust. And debt is usually that fuel. Margin debt is now back to levels that we saw back when the markets peaked in 2000 and 2007.

Of course, debt doesn’t necessarily mean that the market isn’t about to turn over. I prefer to think of margin debt as a sign that the risks are higher today. That is, if and when the market tumbles the deleveraging of the debt can contribute to the downside in a manner that otherwise wouldn’t occur.

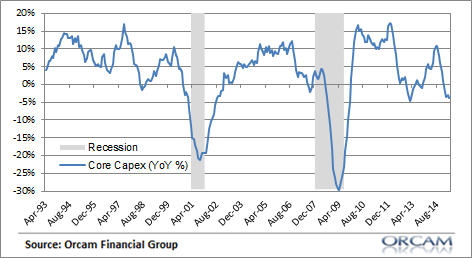

2) Core Capex has Turned Negative. One of the primary causes of the weak recovery has been low levels of corporate investment. The durable goods report from earlier this week showed continuing low levels of new orders. The core capex rate is now negative at a rate of almost 5% year over year. Historically, durable goods orders have tended to correlate highly with the stock market and recessions so this certainly isn’t something that makes me feel terribly comfortable.

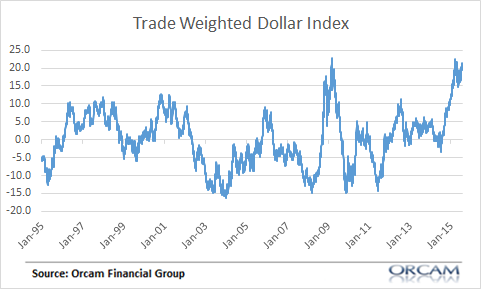

3) The Dollar Surge is a Sign of Emerging Market Troubles. A strong dollar doesn’t worry me, but a dollar that is THIS strong is a sign that something worrisome could be going on. Historically, substantial year over year increases in the dollar have been consistent with a flight to safety. With the recent European and Emerging Market turmoil we’re seeing huge demand for dollars as a good deal of foreign debt is dollar denominated. The current surge in the dollar is a sign that there’s a flight to safety occurring and more turmoil in the financial markets than many might presume.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.