A random Friday edition of three things….

1) I did some catching up on Neil deGrasse Tyson’s new show “Cosmos” last night. It’s the best thing on TV. I’m sure it doesn’t surprise you that a show about the ultimate macro topic is my favorite show, but in all seriousness, you should watch it. It’s really well done, entertaining and extremely educational.

One thing that jumped out at me in last night’s episode was his discussion of “false pattern recognition”. He was explaining how one of our strengths is in finding patterns. So our ancient ancestors were able to look up at the stars and decipher patterns. But they wouldn’t just decipher patterns. They’d see whatever they wanted – Orions “belt” or a snake or a bear. Of course, we know now that there is no belt, snake or bear in the stars. Those were just false patterns.

As I am watching this I start thinking about the markets. Of course, we do the same thing in the markets. We extrapolate out from small data sets. We look at pictures of the past markets and assume they mean something about the future. We build economic models that create a sense of structure where there really is none. It’s an enormous flaw in our attempt to rationalize and make sense of things our brains aren’t fully designed to digest. Yet we continue to do it every single day without acknowledging the weaknesses in this pattern recognition.

2) I got a HTC M8 yesterday. It’s the best cell phone I’ve ever had. As you may or may not know, I very vocally switched from an iPhone several years back (based on the emails I received, this was an unhappy change for many). I was a little ahead of the curve (or behind depending on how you look at it) at that point, but it was becoming clear that Apple’s competitive advantage over Google was diminishing. The Android operating system was becoming too powerful and all it needed was the right hardware to go with it. The HTC is precisely that. This phone is a technological marvel. It’s extremely beautiful – something you’d expect to come from an Apple product. But the software blows your mind. I won’t pretend to know the ins and outs of the phone like a professional reviewer, but as far as Android phones go this one is top notch.

My rule of thumb – if you’re a heavy Google user go with an Android because they seamlessly embed the Google system (your calendar, contacts, email, music, files, etc) into the phone and its daily operations. If you’re a heavy Apple user then buy an iPhone. You really can’t go wrong with either, but with the HTC M8 I think it’s finally safe to say that the gap between the two has been closed.

3) This was a thought provoking piece at FT Alphaville by David Keohane. David cites a SocGen report on the potential for the return of volatility:

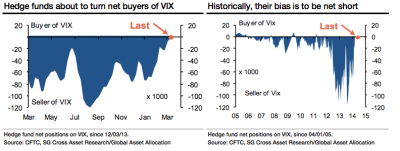

“Net short positions of volatility on the S&P500 (VIX) reached peak levels in August 2013, but were quickly reduced when the VIX started to rise, ironically right after the non-tapering announcement from the Fed. When the Fed finally did start tapering in December, the remaining net short VIX positions were cut back and have now been completely abandoned.”

We can make all sorts of sweeping conclusions about this data, but one thing is pretty obvious – big changes in long-held secular trends are generally the sign of something big to come.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.