Some weekend thoughts….

1) Vanguard now manages $3 trillion in assets which is the same as the entirety of the hedge fund industry (see here for more). This is fantastic news. It means that low fees are winning. When one considers that the S&P 500 generates just a 6.5% real, real return historically you have to be increasingly mindful of how much of that result is due to your fee structure. When you’re paying 10, 20, 30% of your returns per year to a manager then you’re probably paying too much. This is likely to be even more important going forward as bonds are likely to generate lower returns than we’re all used to so this means that high fees will cut into your returns even more than they used to.

It’s a wonderful time to be an asset allocator. Products have never been more accessible at such a low cost. You just have to make sure you’re being smart about your approach. Know that even when you use low fee index funds you’re making an implicit forecast. Know that you’re making active allocation choices. Know that if you pay someone to do this on your behalf then you’re essentially paying for their ability to manage that allocation process for you. The necessity of actively managing ones portfolio isn’t going away just because the fees are coming down. So go into all of this with your eyes wide open and don’t assume that low fees necessarily lead to a better process.

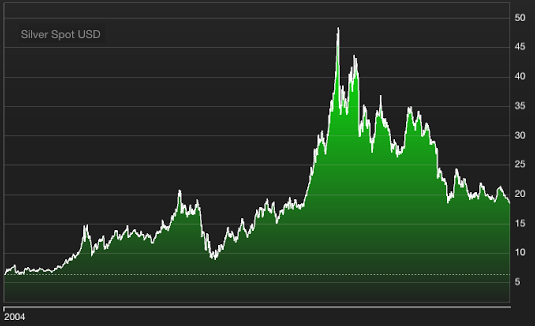

2) Back in 2011 I made one of my rare bubble calls on silver (see here). Well, silver has just about round tripped its price gains on a 5 year basis now:

I think this is one more lesson in understanding the importance of the capital structure and the monetary system. The silver bull market was never based on sustainable trends. It was based more on speculation about the effects of QE and the many high inflation predictions we heard in the last decade. But at the end of the day commodities are primarily cost inputs in the capital structure and they’re very unlikely to generate sustained returns that are well above the rate of inflation.

3) Speaking of silver – I think this is a good time to revisit the post I wrote almost a year ago on “The Biggest Scam in the History of Mankind”. This was a really well done video selling gold and silver as protection against the “scam” that is the Federal Reserve and the US government’s “printing” of money. I said this video was incredibly misleading and that the people who made it were likely just trying to sell you silver and fear in exchange for your hard earned dollars.

I can’t stress how important this is because I really honestly think that a superior understanding of the financial system can help you avoid so many of these hucksters. And anyone who understood the financial system and the monetary system would watch a video like this one and simply laugh. So please, if you didn’t read that post try go read it with an open mind. And if you have questions then please use the forum or the comments here.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

DevilsDictionaries.com

I define hedge funds as “The kind of business that is usually set up by fired (but nonetheless still overconfident) City bankers.”

Geoff

A real real return of “just” 6.5%? I think that’s f-ing awesome!

Very nice call on Silver.

Cullen Roche

Thanks. Not a good prediction as much as it was identifying the high probability of excessively high risk….

jdogg13

Given the recent headlines involving separatist movements in Europe (Scotland, Catalan, etc.), do you still feel that a United States of Europe will come to fruition?

TrollAlert50

Hey Cullen, in the article detailing the specifics of the banking system, you write: “Cash is sold by the US Treasury to the Fed at cost and then distributed to the banking system.”

Could you please explain this a bit more, just for my own curiosity. Let’s say the Treasury sells the Fed a $100 bill (just to keep it simple for this example). Does the Fed pay the paper costs, let’s say 1 penny, to the Treasury? Where does the Fed get this 1 penny to pay for the cost of the $100 bill? And why would the Fed have to pay the Treasury anything? Isn’t the Fed basically providing a service to the Treasury by managing the paper needs of the system?

Geoff

Europe is toast. But maybe a USE will arise from the ashes.

Pat Sun

silver pretty much moves with gold, when you compare gold and gold miners, it’s easy to make two conclusion

1 The cost of mining doesn’t just increase along with inflation numbers

2 as a type of investment, stock in general doesn’t perform better than precious metal because stock in nature is better. There’s nothing nature about stock that makes it a better investment. Otherwise invest in gold miners should have better return than gold. It’s just wrong to say that stock is better than precious metal, or better than commodities. What history really shows is that high tech industry is better than commodities, or health care industry is better than commodities, etc.