There’s a lot going on. Too much to write about in one post so here’s a fresh installment of three things I think I think:

1) Bigger Scare: Oil or Greece?

Oil prices are off about -45% from their June highs. It’s an alarming drop to say the least. While it’s a welcome decline to US consumers who are now paying significantly lower energy bills it’s unclear what exactly is driving the decline and whether it’s a sign of something nasty in the global economy. My best guess is that there’s a bit of everything going on here. That is, we’re seeing the supply build up finally take its toll on prices and OPEC is unwilling to support prices given that they can afford not to (the Saudis, for instance, produce oil at a significantly lower cost than most of their competitors). But we’re also seeing some signs of weak demand in the price. The big worry is that this is a sign that China and Europe are even weaker than we think.

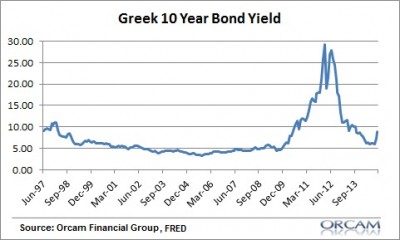

And that brings me to my biggest concern. As I’ve stated previously, I still think the biggest threat to the current economic environment is Europe. In the last few weeks we’ve seen a sharp move higher in Greek bond yields. While this is just some repositioning in bonds due to political uncertainty, it’s a big potential risk in the coming years. The European Monetary Union is NOT fixed and the critical flaw in the system remains in place. Europe won’t see a stable monetary system until this is resolved and that means that high peripheral debt and unemployment are very likely in the coming years. That creates huge political uncertainty. At what point do Greek citizens or German citizens just get fed up with what is clearly an unworkable system? The worst case scenario is a form of restructuring that create all sorts of near-term uncertainty.

While the decline in oil looks frightening the rise in Greek bond yields is a reminder of an even larger potential disruption to the global financial system.

2) The looming deflationary & disinflationary threat

Disinflation was the main theme in 2014 as investors realized that QE just doesn’t cause high inflation. And that trend is likely to continue into 2015 thanks in large part to the collapse in oil prices. We are likely to see very low levels of inflation in 2015 thanks to this decline. That’s a good thing in that it’s a sign that costs will remain low, but it’s a bad sign because it also means demand is too low.

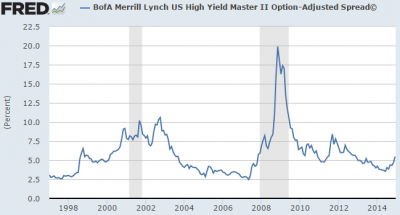

This decline in energy prices will give Central Banks even more wriggle room than they already have and increases the odds of intervention in 2015. I still do not think that tightening of any form is on the table in 2015. At least not in the first half of the year. More importantly, Central Banks are likely to grow increasingly concerned about the ripple effect from the fall in energy prices. With high yield bonds spiking we’re likely to see a growing number of defaults in many high yield issues. Bank exposure to the energy sector is not crippling like the mortgage crisis, but it is larger than many might think. This all adds up to Central Banks that will likely lean heavier on the easing side than the tightening side.

So, the disinflation is likely here to stay. Will it turn into a full blown debt deflation? Hard to say without a major set of defaults either at the sovereign level (Russia, Greece, etc) or a wave of defaults that Central Banks don’t foresee. For now this looks like a disinflationary event with some risk of a deflationary tail risk.

3) About those 2015 Year-end forecasts

Business Insider had a good piece over the weekend on the 2015 forecasts from Wall Street’s biggest analysts. Barrons also discussed the forecasts citing the lack of a single bear. But the real question is whether anyone should care?

In my view, no one knows where the price of stocks will be in 12 months. It’s a silly game to try to guess where the price of such a dynamic market will rest in such a short period of time. And we have to recognize that most analysts are pretty smart – that is, they know there’s about a 70-80% chance that stocks tend to rise in any given year so most of these analysts are just playing smart odds. Bearishness in the equity markets can be career suicide for most analysts at a big bank even though the media makes rock stars out of bears who regularly scream “fire” in the crowded theater of the markets.

Besides, most Wall Street analysts are perennial bulls because their firms rely on being perennial bulls. These are firms that make money by ensuring that people are being actively involved in the markets. It doesn’t help their business model to move people into cash or scare investors away from acting. They sell products for which they want there to be rabid demand. And these analysts help to foster the environment which feeds that demand. Every investor should realize this before reading a forecast from any big Wall Street firm. So do yourself a favor and ignore the myth that anyone has a crystal ball about where markets will be in 12 days, 12 weeks or 12 months.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.