Here are some things I Think I am thinking about:

1) Here’s a new episode of Three Minute Macro.

This one is “Where Does Money Come From?” I’m still getting the wheels greased here and building up for more interesting and advanced topics, but these are good building blocks. I hope you enjoy it.

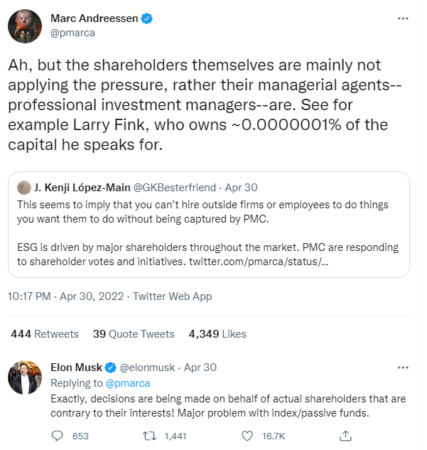

2) Passive investing is ruining the world (again).

Marc Andreessen and Elon Musk were railing against passive indexing over the weekend and that sparked a big debate about the long-term impact of passive investing and how it’s causing all sorts of market and economic distortions.

I don’t want to downplay the potential risk of a few firms having huge amounts of voting rights over corporate actions, but I tend to think this whole narrative is exaggerated. The primary reason I  say this is because these firms vote with management in 90% of cases. This is precisely what a passive investor wants. The passive investor doesn’t want to have discretion in how a company is run because the passive investor believes that they cannot make a meaningful impact in actively dictating corporate performance.

say this is because these firms vote with management in 90% of cases. This is precisely what a passive investor wants. The passive investor doesn’t want to have discretion in how a company is run because the passive investor believes that they cannot make a meaningful impact in actively dictating corporate performance.

The purpose of passive investing is to let managements run their firms and avoid trying to pick and choose how that entity should be actively managed. So it would make sense that these firms defer to management in 90% of cases.

So, I don’t really see the issue here. In fact, I’d be much more alarmed if these firms were activists and trying to dictate every move in corporate America because we know that outside investors tend to be very bad at predicting the future performance of corporate performance.

3) Should we cancel student loans?

The debate about student loans has continued to rage as President Biden discusses potentially extending the moratorium on student debt payments. I’ve discussed this issue in detail in the past and my view hasn’t changed. In fact, if anything, I’d argue that forgiving or delaying student debt payments makes even less sense now than it did in 2019 when I wrote this:

“forgiving student debt doesn’t actually solve the root of the problem which is the high cost of college (which is expensive because it’s worth it) and could actually make that problem worse.”

The current inflation is a problem that we should not be exacerbating and the moratorium is a stimulative tax cut. But more importantly, it does nothing to actually solve the problem of high college costs. In fact, there is mounting evidence that the government’s involvement in subsidizing this space has increased college costs so if you don’t somehow make college free then the problem doesn’t get resolved by further subsidizing and actually incentivizing student debt.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.