Here are some things I think I am thinking about.

1) So. Much. Crypto.

I am about to write a post entirely about crypto. But before I do that I want to make it clear that this space gets WAY too much attention. I mean, we’re talking about an asset class that is incredibly small relative to the scope of the global financial asset portfolio. At just 1% of global financial assets the entire crypto space is about the size of Amazon. Amazingly though, the crypto space dominates the airwaves. It’s virtually all anyone can talk about these days. So, here I am to pile on.

Of course, the reason it’s getting so much attention is because of the sharp increase in prices. Crypto is the get rich quick narrative of the year. Or, more recently, the get poor quickly narrative. I was looking at the long-term charts of this space and it’s just incredible. Here’s the recent rise and fall:

And here’s the max drawdown chart. This is an asset class that has only existed for 10 years and has already experienced three drawn out 80% declines. Amazing stuff and kudos to the people who actually held on through all of this.

I don’t really know where I am going with all of this. I guess I am trying to add some broader perspective around narratives that some times make crypto seem much more important to our economy than it really is. Which, I guess is consistent with how the financial media tends to focus on these things. The highest flyers get the most attention, whether it’s a silly ad talking about how “Joe Schmo made $1MM betting on XYZ Penny stock” or whatever.

2) Let’s Talk About Michael Saylor Again.

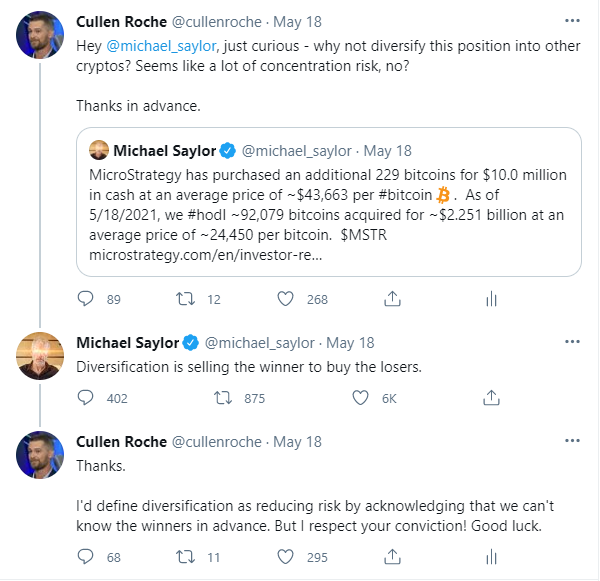

The amazing thing about Twitter is that you can directly talk to people you would never otherwise communicate with. For instance, over the weekend I posted the following retweet from Michael Saylor and he responded:

This is an interesting look into his perspective on his massive Bitcoin bet and the way he thinks about asset allocation. In case you haven’t been following, Microstrategy, a $4.5B data analytics company, has built up a $3.5B position in Bitcoin. Michael Saylor, the firm’s founder has argued that Bitcoin is a better cash-like reserve than actual USD.

I love everything about this story. As I’ve mentioned before, I don’t love when certain firms just repurchase shares, pay dividends or hold cash. I’m not anti-buyback like some are, but I think there are many cases where the executives are savvy asset allocators who could diversify their assets in a manner that complements their own internal asset allocation. Saylor is a smart dude and capable asset allocator. I love the outside the box thinking. But I think he really misunderstands diversification as it’s used in standard finance. After all, when you diversify into something like an index fund you are specifically doing THE OPPOSITE of what Saylor says. The index systematically sells your LOSERS and replaces them with firms that are winning. This is why I’ve referred to index funds like the S&P 500 as a form of momentum investing and it’s the main reason why index funds beat the pants off of so many active investors. The active investors hold onto their concentrated losers too long….

And that’s why there’s something about the concentration of this position that makes me very uncomfortable. Maybe I am just too much of an old school diversification style asset allocator, but a huge concentrated allocation in such an early asset class would make me worried. It’s fine to think that cash is trash. But that doesn’t mean you should massively overweight into something that regularly falls by 80% and is consistently losing relative market share in the crypto space. I mean, Bitcoin was once 100% of all crypto assets and is now just 48%. Who’s to say that won’t go to 0%? Or even just single digits? Sure, Bitcoin could still do okay in that scenario, but it seems like an awfully concentrated high risk bet if you ask me….

3) Paul Krugman – Not a HODLER.

Speaking of people who really think crypto is worthless – there’s Nobel Prize winner Paul Krugman. Dr. Krugman wrote a piece over the weekend that obliterates crypto’s utility. He basically summarized it as a useless asset class that is built on ponzi schemes, technobable and Libertarian derp. In fairness, he’s not that far off right now. There are fairly limited use cases in the developed world and the Bitcoin ecosystem is rife with econobabble that resembles most of the Austrian Econ type nonsense that I’ve long debunked on this website. But I think he’s way too negative about the potential future here.

As an example, I can see a future where there is a FedCoin. And FedCoin is created endogenously to help validate a title transfer blockchain. And every one of us who buys and sells homes uses a P2P system to transfer FedCoin (easily convertible into bank deposits) to buy and sell homes. In doing so you would walk up to a home seller, buy their home on the spot and the title of the property would transfer instantly and seamlessly. No title company, no real estate brokers, etc. You would cut out billions of dollars of fees in an industry that is rife with middlemen.

Of course, none of that needs to include Bitcoin or all the other coins that rise and fall so violently. An endogenous stable coin is perfectly fine for all of this, but I think it’s a massive overstatement to claim that Blockchain technology cannot completely transform some industries in the future….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.