Here are some things I think I am thinking about today:

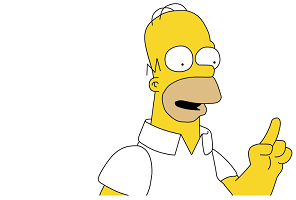

1) Hello, 9-1-1: I’d like to report a mass murder. Here’s a JP Morgan note that has been going around twitter the last 24 hours. I don’t have much to say here other than this – most of the people on this list have a few things in common – political bias and/or a permabear bias. So, don’t be biased or one day you might end up on a list like this getting carried out in a body bag.

(Thoughts and prayers – image via @nickatfp)

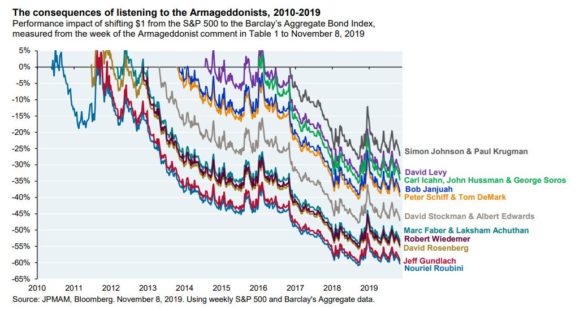

2) Here’s the worst take ever on Twitter. The socialism movement seems to be gaining traction. Unfortunately, it seems to be largely due to people presenting fake news about capitalism. For instance, here’s Robert Reich on Twitter declaring that all billionaires are basically defrauding the system:

This is over the top. I mean, Donald Trump tweeted 82 times on the same day and Reich’s Tweet was still worse than all of Trump’s (perhaps combined). That’s quite an achievement.

Look, I agree that inequality is a problem. I don’t think American capitalism is serving everyone as well as it could. But we can make pragmatic conclusions about all of this without losing our minds and declaring that all billionaires have gamed the system or worse, saying that billionaires shouldn’t even be allowed to exist. I’ve discussed how no one is self made. There are so many factors that go into success – lots of luck, government support, social support, family support, education, intelligence, hard work, etc. These factors all play a big role in the outcomes. So it’s just silly to boil it all down to the idea that the system has created a playing field that is so uneven that only fraudsters can get rich.

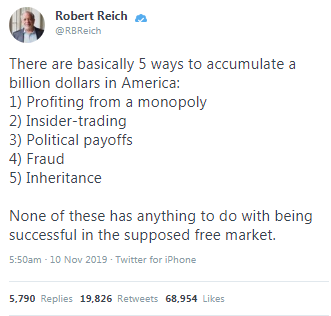

3) Congrats on the record debt levels! Household debt levels jumped to almost $14T this quarter according to the NY Fed. You’re likely to read lots of scary stories about high debt levels and all that. But let’s circle back to accounting 101 here. Remember, all financial assets have corresponding liabilities. So, when someone starts screaming about how the debt levels are high we should ask them what the asset levels are. Balance sheets are called balance sheets because, voila, they balance. At the aggregate level all those financial assets and liabilities just cancel out and all we have left is a big pile of real assets (like houses, cars, factories, etc). So, it’s not so important what the quantity of the financial assets/liabilities are, but really what they are funding and whether that funding is sustainable.

For instance, when the orange lines surged higher in 2006/7 it wasn’t necessarily concerning except for the fact that they contributed to an underlying unsustainable surge in house prices. So, you ended up with all this debt being written at prices that were too high. I am cherry picking a recent example, but debt crises are actually pretty unusual events because they don’t tend to be attached to systemic prices like house prices. You could have spent all of modern financial times screaming about ever increasing debt levels and you’d have been wrong just about 99% of the time. Sure, you would have been right a few times and you might even get on CNBC a bunch because of it, but we shouldn’t confuse that with making good predictions.

So, the bottom line is, it’s more complex than just looking at the debt and I could probably write an entire book on this topic, but I am not gonna do that because that would be a boring book and people probably wouldn’t read it anyhow.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.