Here are some things I think I am thinking about:

1) MARKETS IN TURMOIL! You just have to love the financial media. Every time there is a small hiccup in the global economy they latch onto it to drive up viewership. Fear is, by far, the most powerful emotion and the media has mastered the art of selling it. I suspect this is one reason why markets have become more volatile over the last 20 years. The 24 hour news cycle isn’t making us more informed and rational. It’s making us stupider and more emotional.

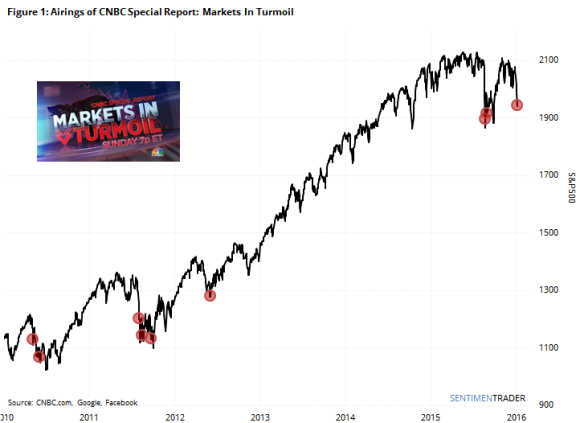

That said, you just have to love this chart from SentimentTrader showing CNBC’s airing of their specials “Markets in Turmoil”. The timing literally could not be worse:

2) Total Return is All That Matters – What a disastrous start to the year. But let’s talk about last year for just a hot second. There seems to be a widespread problem where people don’t calculate their total return. For instance, the S&P 500 finished the year 1.38% higher. Except if you don’t count dividends. In that case, it finished 0.7% lower. And for some strange reason the mainstream financial media reported that the S&P 500 finished negative on the year. Almost every mainstream media outlet ran a front page report last weekend citing the negative finish. Except it wasn’t actually negative!

Failing to report the dividends in the total return of a stock is like failing to report the interest payments of a bond. Can you imagine a 1 year CD paying 5% (boy, those were the days, huh?) where, at the end of the 1 year period, you determined that your total return was 0% because you excluded the interest payment? The exact same thing is true when you report stock returns without dividends. After all, dividends are reported as distributed profits. Why would we exclude distributed profits from the total return of a financial asset? We wouldn’t. Errr, we shouldn’t….

Anyhow, there’s lots of ways to find this data if you’re looking for it. Yahoo Finance adjusts for dividends on their historical prices page so if you’re looking for the total return of the S&P 500 just pop on over to the historical prices page on a ticker like SPY and you’ll find the dividend adjusted price updated through the year….

3) Lose Money More Efficiently in 2016! – I loved this post from Monevator, which is a very good website in case you don’t follow them. They detailed some great ways to lose money this year including:

- Sign up to some bearish investing websites

- Buy shares tipped by crazy-sounding people on social media

- Trade as much as possible

- Ignore trading costs

Perfect!

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.