Sorry for the recent radio silence. I’m trying to focus my energy on writing about the markets when it’s pertinent as opposed to just spewing a daily or weekly note for the purpose of generating eyeballs.

1) Hit the mute button. There is going to be a lot of noise in the coming months about who will win the Presidency and why that person is good or bad for the country. As I’ve noted on many occasions, politics is the absolute best way to wreck your portfolio. The objective fact is that the economy is extremely complex and the political relationship between markets and politicians is even more complex. For instance, you might claim that President Trump is the most important factor in an economic cycle. But what if he has a Democratic Senate and House? What if he has a Republican Senate and Democratic House? What if some world changing boom (like the internet) just happens to occur under his watch? What if some world changing collapse (like a pandemic) just so happens to occur under his watch? There are so many random variables in there that it’s crazy to cherry pick one variable (like the President) and then make sweeping generalizations.

So, hit the mute button on politics for the next month. Yeah, I know it seems really important and it probably is in other aspects, but the stock market isn’t going to rise and fall solely based on the President. There are just too many other important variables that play a role there. So, as always, don’t let your politics infect your portfolio management.¹

2) Trump’s tax mess. The NY Times apparently got their hands on Trump’s tax returns and the media was having a field day with it. What to make of this? It’s a messy subject, but the bottom line seems to be this:

- Trump is aggressive with his tax deductions.

- Trump doesn’t pay a lot of taxes most years.

- Trump has managed some businesses very badly.

- Trump has managed some businesses very well.

None of this is terribly shocking in my opinion. Here we have a guy who is a spectacular salesman (mostly of his own brand) whose actual businesses don’t perform that well. Those businesses are large and complex and he uses that to his advantage to minimize his taxes. I’m not sure this tells us as much about Donald Trump as it does about the tax system that seemingly favors the ultra wealthy.

3) Inflation is hard to predict. I’ve spent most of the last 10 years basically trying to predict inflation. It is, in my opinion, the single most important variable you can try to predict in the markets. After all, it tells us what value vs growth stocks will do. What foreign vs domestic stocks will do. And what bonds and commodities will do. If you know future inflation you have a huge advantage over other investors. The thing is, inflation is really really hard to predict. No one seems to have a coherent general theory of inflation. And most of the old theories that appeared right, have been debunked in the last few decades as governments have printed trillions and inflation has fallen.

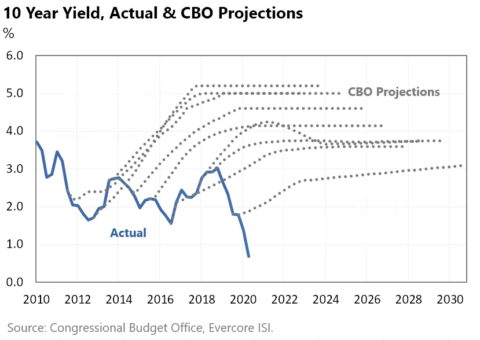

So, I was a little surprised when I saw this data point from Evercore alongside the general reaction on Twitter which amounted to “wow, the CBO is soooooo dumb”.

Yeah, this is easy to criticize in retrospect. I’ve been one of the few people who consistently stated that inflation would remain “lower for longer” throughout most of this period. But even I will admit that this was a very difficult position to maintain. After all, a smart market analyst will generally defer towards some sort of mean reverting prediction because the anomalous outcome is the lower probability outcome. It’s like being a permabear. It’s extremely stupid to be a permabear because stocks usually go up. So, if you work on Wall Street and you like your job then the smart move is to always predict some sort of mean reverting return of something like 8-10%. And if the market falls 40% then you look really stupid, but that happens so rarely that the smart average prediction is to always predict a bull market. You’ll be right more often than not. Same basic thing here. Inflation has averaged 3% or so for 100 years. The anomalous outcome is 1% inflation. So, it’s not surprising that your typical inflation prediction has been higher on average. In short, predicting things is hard, especially about the future.

¹ – Speaking of mute buttons. Did you watch that shit show of a debate last night? I think Jake Tapper said it best – “that was a hot mess inside a dumpster fire inside a train wreck.” The moderator is going to need a mute button for the next debate.

NB – On a brighter note – you might be interested in this data point on food trends. Eating french fries is more exciting than eating avocados:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.