Here are some things I think I am thinking about:

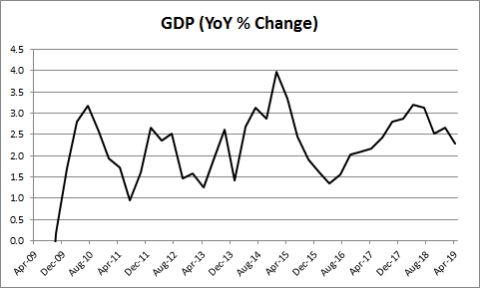

1) Q2 GDP – more of the same. Second quarter GDP came in at 2.1%. Pretty weak. But more of the same. As I’ve long been pointing out – this is the golden age of low and stable growth. It really is a sort of Goldilocks economy. Not too hot, not too cold. Just right. But this general trend has been going on for 10 years now.

2) Negative rates everywhere. There has been a lot of chatter in recent weeks about how bond yields are going negative all over the world. Some people think this doesn’t matter. Others think it’s insane. Others think it’s the new normal. No one really knows and it’s probably more specific to each individual economy than most people think, but one thing that is certain is that this has completely changed the risk profile of bonds. Yesterday, Joe Weisenthal asked the following question on twitter:

It’s largely psychological, but the important takeaway, from a risk management perspective, is that the bond you hold at -1% is much riskier than the bond you hold at 1%. This is due to the bond’s convexity. In other words, its exposure to interest rate risk is not linear. Instead, as yields fall the bond actually becomes more sensitive to interest rate risk.

Let’s say you hold a 10 year T-Bond and rates fall from 3% to 1%. In the following year you should make about 22% in total returns because prices rise as rates fall. Most of that comes from the re-pricing of the bond. If rates rise from 1% to 3% you will lose about -16%. But if you hold that 1% yielding bond and it now falls to -1% then you will also gain about 22%. But here’s where things get interesting – if rates rise from -1% to 1% then you will lose about 20%. In other words, you are exposed to a 4% greater downside loss when you hold the negative yielding bond when compared to the positive yielding bond. So, despite being the same AAA rated government issued T-Bond the negative yielding bond has a significantly worse risk profile than the positive yielding bond when rates rise.

The thing is, holding the negative yielding bond has limited upside and greater downside. After all, while rates can go negative they aren’t going to go more and more negative forever. So this isn’t like the world where rates are 10% and falling to 0%. No, when rates are -1% there is a far worse asymmetry in the probable outcomes because holding a negative yielding bond is essentially a bet on increasingly more negative yielding bonds (an unlikely, or at least limited upside outcome) with increasing relative downside risk.

In my opinion, there has never been a time where active management in bonds has been more sensible. Risk management is going to be the name of the game in the coming 20 years as investors wrangle with rising interest rate risk. Holding an index fund of bonds or plain vanilla exposure to something like a bond aggregate just isn’t going to cut it.

3) A paradigm shift? Here’s a thought provoking piece from Ray Dalio about the current paradigm shift he believes we’re undergoing. In short, he thinks the world is likely to enter a period of even greater Central Bank involvement and monetization that will result in poor bond returns and uneven and/or poor returns in stocks. His basic thesis is own gold because it will protect from both monetizations and social instability. It’s an interesting thesis and not one I entirely disagree with, but I do wonder how much he’s just talking his book here. After all, Dalio’s most famous for his all weather strategy and real assets play a big role in that. And so he’s always kinda bullish on all the different parts there. So in a relative sense, if he’s bullish on gold with a 25% weighting in his portfolio and the rest of the world is only holding a 5% allocation to gold then Dalio, despite being underweight gold, actually looks really bullish. I don’t have any idea what his actual weighting is, but I suspect this is where he’s coming from….Anyhow, go have a read. It’s worth the time.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.