Here are some things I think I am thinking about.

1) About this negative yield thing….Interest rates just keep pumping lower. There’s now over $15 TRILLION worth of bonds in the world with a negative yield. Now, negative yields aren’t as crazy as some people think. There’s perfectly practical reasons for yields to be negative (for instance, if you believe inflation will be very low or negative). But check out this price action in 30 year Austrian Government Bonds:

If that’s hard to see, let me explain – that’s a 0.25% yielding instrument that has increased in value by 60% in the last 12 months. This is an extreme case I am cherry picking, but it shows what is happening to some degree across the entire bond market.

The thing is, this is only sustainable in the case that these yields continue to move lower and lower. And if they don’t then you end up owning a zero yielding instrument that is no safer than cash and yet exposes you to an insane amount of principal volatility. I think people need to start being careful about this. I’ve been quick to debunk bearish bond calls in the last 10 years and there’s a good chance this trend is a long-term one, but the amount of short-term risk in bonds is tremendous.

2) The government piggy bank. I was watching Bloomberg TV the other day when MMT advocate and Bernie Sanders advisor, Stephanie Kelton came on. She was asked how Congress will pay for universal healthcare:

“The real answer is that Congress will authorize the spending and it will take place so that the government pays the tab rather than the rest of us”

Yikes. Who does she think the government is comprised of? Martians? This sort of thinking is reminiscent of corporate CEOs who don’t think it’s appropriate to expense stock options because you can issue stock from thin air. Who do they think is paying for that stock? The tooth fairy?¹

While I like a lot of what MMT says their understanding of “funding” is one place where I think they make some fairly serious mistakes. Of course, the government is comprised of all of us in a similar manner in which a corporation is comprised of its owners. Forming a government or a corporation does not relinquish liability entirely and it certainly does not mean that no one “pays for” the way that entity expands its balance sheet.

As I’ve explained many times, the way we “pay for” government spending is via taxes and inflation. And when inflation is low (as it is now) the cost of that spending is low. And while that might be a reasonable argument to debunk hyperventilating debt fears it does not mean that we don’t pay for the tab from government spending.²

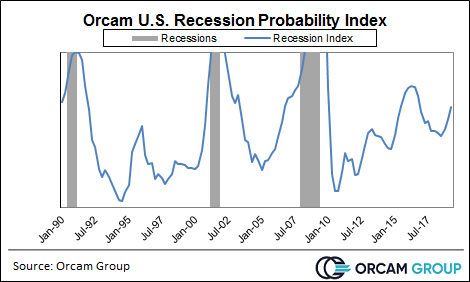

3) Recession calls all over the place. As I noted back in December when recession fears and inverted yield curves were leading to lots of recession calls, there was no need to panic. Things look a little worse now, but not by much.

I use a pretty simple countercyclical model to try to assess the current risk of recession. At present it is consistent with a rising risk, but not yet in official recession territory. It’s basically been in expansion mode for 10+ years while I’ve been using it in real-time so the track record is not bad so far.

Interestingly, it looks an awful lot like 2015 when we had a global slowdown and a manufacturing recession, but not a widespread and official recession. So, I wouldn’t overreact just yet. Things are slow and weak, but what else is new?

¹ – The tooth fairy is actually a good example here as some people might be inclined to think that the tooth fairy doesn’t fund her spending. Oh, but she sure does fund that spending. She funds it from magic fairy dust. Just kidding. The tooth fairy actually works in a sweatshop in China by day and gives money to children at night.

² – The argument from many folks here is that there is little to no cost of government spending when inflation is low and there is excess capacity in the economy. The counterargument to this is that inflation would be even lower than it presently is if the government wasn’t spending what it currently is. In any case, it’s incoherent to say that the government does not fund its spending. Every financial transaction in the economy is funded by a counterparty and having a Central Bank and a printing press does not mean you are above the basic laws of finance.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.